What Would Help You Save More?

Short of, you know, having more money

I participated in a televised panel last week and exhorted a live studio audience full of tattooed and bearded young people to save for retirement, starting now/soon/yesterday, no matter what. Even if you’re also paying down debt, even if you feel strapped for cash, even if you’re helping out family members: try to put a little away. Retirement is a terrifying prospect, one many of us may not even live to see at the rate things are going, but still. Fatalism is not a strategy. You could end up living until 90, and at that age you probably don’t want to live out of your car, so it’s wise to plan.

We May Not Live To See Our Glory (Retirement)

If you do save wisely, you could end up like “the frugal librarian” who, upon his dead in his late 70s, donated four million dollars to the University of New Hampshire, his employer for decades.

A frugal librarian drove an old car, ate TV dinners – and left $4 million to his university

Or Vermont’s “million dollar janitor.”

Here’s how a janitor amassed an $8M fortune

Say you’re not a frugal, introverted, and employed white dude in New England and you still want to amass your version of a fortune. How can you make it easier on yourself? Boston College’s Center for Retirement Research recently delved into that question. Here are its key findings:

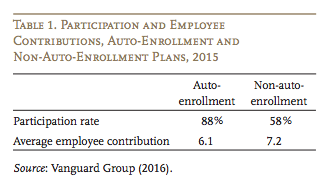

In short, tax incentives don’t move the dial but “nudges” do. The behavior of most individual savers isn’t affected much by the government adjusting tax laws. The .pdf goes into more detail on this, if you’re interested:

lower-income workers are more likely than higher-income workers to be passive savers whose saving behavior is not responsive to financial incentives. Overall, the findings suggest that offering more generous tax incentives would cost the government revenue without significantly increasing retirement saving.

On the other hand, you can help yourself by making saving the default. Automate everything. Take any element of choice out of the equation, because of course if you’re deciding whether to buy a cute shirt today or a week of in-home health care fifty years from now, it’s easy to go with what’s tangible, appealing, and right in front of you. Nor does it make you a bad person to give into temptation. Still, you can work with yourself to help you think about the future, “set it and forget it”-style. If you’re one of the 50% of American workers who can get a 401(K) — or one of the new “auto-IRAs” in states like California and Connecticut — from your employer, take advantage of it! Your employer can help by assuming you want in unless specifically told otherwise.

workers in traditional “opt-in” plans commonly set their contribution at the plan’s match threshold, the maximum contribution that employers choose to match, and typically stick with their initial contribution and investment allocation decisions. They also show that auto-escalation — gradually raising the default contribution rate over time — raises contributions in auto-enrollment plans above a low initial default, typically by shifting an additional 1 percent of the wage into the plan each year until the contribution reaches a higher target amount. The study by Chetty et al. supports the notion that such “automatic” changes in retirement saving raise overall saving, because they are generally not offset by changes in other types of saving.

There is a danger that you will put in less than you might have otherwise, though, so make sure your employee contribution is as high as you can stand it to be.

The researchers conclude that more states and businesses should implement “auto-IRAs”:

Auto-IRA programs would default a substantial portion of today’s uncovered workers into a payroll deduction plan. If retirement saving is primarily responsive to behavioral incentives, the Auto-IRA could be the initiative that offers the greatest promise for increasing retirement saving.

My version of an auto-IRA was my father telling me to start one as soon as I got to NYC and started working, even though I was only making $500 a week. He told me he’d even front me the cash for an initial payment but I told him I’d handle it; it seemed like an important Adulting moment for me, and I’m still proud that I was able to do it. Now, if only he’d added that I should have researched where to open an IRA instead of merely walking into a bank branch on Montague Street in Brooklyn and letting some crazy clerk sign me up for some terrible, low-performing mutual fund. My IRA didn’t start making money until I switched it over to Vanguard a few years later. Still, it was a start! And since not everyone has an investment savvy father-figure helping them out, I’m all for our jobs picking up the slack.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments