With Great Spending Power Comes Great Responsibility, And Apparently Guilt

“I’m a Trust Fund Baby; you can trust me”

This Refinery29 confessional by Cassidy Smith hurts my heart. Smith is a young woman who makes $27,000 a year and yet owns a condo in Williamsburg because she has a trust fund, but she only has the trust fund because her father died in an accident when she was young. She has so little peace about her financial situation, and so much baggage — although, she hastens to inform us, not the quilted Chanel kind.

I’m The Trust Fund Baby You Love To Hate

She seems to carry around a terrific amount of anxiety on a daily basis because she has this money: money she didn’t earn, money intended to help compensate her for a tragic loss, money she takes pretty good care of. Now she feels that she must justify how she spends it to the Internet at large.

I spend absurd amounts for artisanal fashion, partly because I feel good spending money that supports a good cause. And also because, let’s be honest, I’m a sucker for beautiful things. (Of course, you would never catch me with a quilted Chanel purse on my shoulder. That is just too much.) I clean my own apartment, buy my organic food in bulk, and eschew Seamless. I (almost) always take the subway.

I want to be responsible, but I don’t want to be cheap. I know that your spending will grow to fit the container you give it, so I create meticulous budgets for myself — $300 a month for restaurants, $50 a month on beauty, for example. Then, almost without fail, I break those budgets — $460 a month and $100 on average, respectively. My Mint budget is a sea of red. I can never figure out exactly what my monthly spending should be. Should I base it on my earned income of $27,000 a year? That is way too low. Should I base it on my full income? That seems irresponsible. How do you say no to a vacation or a dinner with a visiting friend when you have an extra $200,000 a quick wire transfer away? It feels disingenuous to say, “That is not in my budget.” But if I didn’t ever say that, I know I could easily run through my nest egg in a year on expensive dinners, travel, fashion, and health fads.

Can you read that and not want to give her a big hug, and then direct her to the nearest capable financial advisor? What about this: “I hope once you get to know me, you’ll decide I’m not so terrible, even though I haven’t fully convinced myself of that yet”? The language itself is telling: I mean, consider the implications of referring to yourself, even colloquially, as a “baby.” She hasn’t yet developed the confidence that can come from supporting yourself, from knowing you can pay your own way in the world. She doesn’t feel like a grown-up. Inflated worth, arrested development.

Also, turning to the Internet for love and acceptance is a plan on par with cribbing part of your convention speech from that of another wannabe-First-Lady only 8 years ago and hoping no one will notice.

I mean this seriously: poor [trust fund] baby.

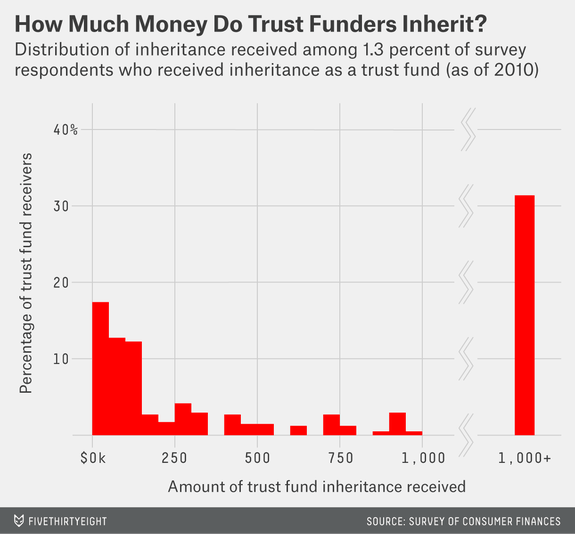

Trust funds are double-edged swords, mixed blessings, and other cliches as well. They also range considerably. Not everyone who has one is free to approach the world like Paris Hilton. Mona Chalabi covered this for FiveThirtyEight: although a third of all trust-fund kids have a nest egg that could fairly be described as massive (over a million dollars), a significant cluster of them receive distributions from an amount that’s under $250,000, total. The median trust fund, according to her data, is $285,000.

There was a trust-fund baby at my first job in the city who lived, rent-free, in an apartment her family owned on the Upper East Side. When I told her once that I jealous, she shrugged and said, “I end up spending on taxis what I would be spending on rent.” Not too long after, she quit to go surfing full-time in Costa Rica. I kind of admired her, frankly: she was young, hot, privileged, and if anyone had a problem with that, she didn’t give a shit. She kept anti-hangover medicine in the top drawer of her desk.

She reminds me of another recent “confessions of a trust-fund baby” piece which ran at The Week, this one by Caroline Faber (not her real name).

Confessions of a trust-fund baby

I was the cliché everyone loves to hate. I spent my days eating organic eggs benedict at the local café, doing The New York Timescrossword puzzle, then traipsing off to afternoon yoga. I fell into a group of friends who, like me, had outside financial resources (read: rich parents). We spent our money on shopping, ski trips, all-night parties with $50 entry, and drugs. I could blow $350 in a weekend on coke, ecstasy, and alcohol.

I’ve known lots of other people with trust funds, because that’s what happens when you go to a private liberal arts college and then live in New York, and at least in my experience, Faber and my old colleague are outliers. Even most people who have family money in the bank don’t get enough to live like socialites. In fact, the amounts they receive are often just high enough to destabilize them.

At one point I had three good friends with trust funds. None of them was doing designer drugs or hitting up Nobu once a week; but, at the same time, none of them had — or, for that matter, has today — a full-time job. Each went from one thing to another, career-wise, perennially dissatisfied, because they weren’t rich enough to stay home, but neither were they propelled by need to pick something and make it work. Like Faber, who recounts that her sister had five different career starts, and who herself would think, when she had a hard day at the office, “‘I could just quit. It doesn’t matter.’”

First-world problem? Sure, maybe. But I have sympathy for anyone whose internal critic is activated by money. Most of us worry that we spend too much. Many of us blow our budgets. Although the pains of having too much could never be compared with the pains of having too little, Smith’s issues are actually pretty easy to relate to — and, again, with some help, relatively easy to fix. At least we know she has enough to afford a good therapist.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments