On My Own: Saving $20K in Six Months

After succumbing to lifestyle creep, it was time to take control.

“Look me in the eye,” my grandma said.

The way her hand was pincering my chin, it was hard to do anything else.

“Are you stripping?”

“What?!?” I squawked. “Grandma! Why on earth would you think that?”

Her gaze remained fixed on my face.

“Your father said you’ve been paying for almost everything by yourself for the past two years, no loans,” she replied. “Plus, you just walked in with a new Prada bag. Where is all this money coming from? Your dignity is priceless, you know.”

I exhaled slowly. “Grandma, I know this sounds weird, but people — well, companies really — pay me lots of money to write for them. I promise, there’s absolutely no nudity involved.”

Even after spending almost a half hour explaining my freelancing career to my grandmother, she remained a little skeptical. And I couldn’t blame her. I still have a hard time wrapping my head around it, and I’m the one writing the content and cashing the checks.

The last time I updated you guys, I was returning to Cal Poly after a short stint in Silicon Valley. There was roughly $7,000 in my checking account and $2,000 in my savings account — which I was more than happy with, considering I’d already paid off my student loans from freshman and sophomore year.

I’d started getting emails from prospective clients all the time. I’m not going to play it cool: Having so many people interested in hiring me felt amazing. But even though I wanted to accept every job I was offered, there was no way I could maintain my GPA while writing more than I already was.

I decided to pick my gigs based on a very simple formula. Whenever someone new reached out, I’d take my old rate and add 10%. This move felt both risky and arrogant, but I figured it would help cut down on the requests I received. Would some people really pay me $500 for a day’s worth of writing? It turned out they would.

In February, I made $5,000. In March, I made $6,000.

Having so much money piling up in my bank account was bizarre. And you know what they say about lifestyle creep? Well, I totally succumbed.

Case in point: I used to be a faithful shopper at Food 4 Less, a no-frills grocery store owned by Kroger, but trekking across town to the store took forever, and there was a new Whole Foods copycat right across the street from my apartment. Dinner went from cheap, but yummy, homemade chili, to $8 takeout boxes from the hot foods bar.

My social life got a similar upgrade. In the past, I’d always suggest free (or nearly free) activities, like hiking, hanging out at the pool, or walking around downtown. Now, I’d leap at the chance to go to nice restaurants. Scanning the menu and remembering I could order an appetizer and an entree (and not the skimpy house salad, either!) was always a thrill.

Oh, and that Prada bag my grandma spotted? It wasn’t a fake. I need a nice purse for my post-grad job, I reasoned as I typed in my debit card info. When doubt crept up (It’s almost two months’ worth of rent!), I pushed it away.

Things might’ve continued on in this fashion if I hadn’t read Paulette Perhach’s “A Story of a Fuck Off Fund” for The Billfold. I was abruptly filled with horror and shame. What had I been doing for the past two months? I’d been blowing my hard-earned money on apricot chicken tagine and designer bags when I should’ve been saving for the future and protecting myself from bad situations. I’d always prided myself on being practical, even thrifty, but the sudden cash influx had gone to my head like those $12 cocktails I’d grown fond of.

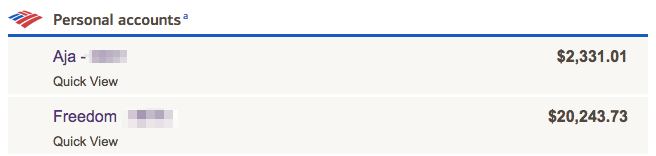

It was time to take control. I started directing 50 to 75 percent of each paycheck to my savings account, which I renamed “Freedom.” I limited my trips to the organic grocery store to once a week, hitting up my old budget-friendly haunts for the majority of my food. I canceled my Hulu, Skillshare, and Audible subscriptions; I was barely using them, anyway. I asked friends and dates if they wanted to picnic on the beach or visit the butterfly grove, rather than visit one of SLO’s many fancy restaurants.

I considered returning the Prada bag, but ultimately didn’t. Some people get tattoos as reminders of their mistakes; I use a purse that makes me feel a little guilty every time I look at it.

Pulling in the reins definitely paid off. Here’s the current status of my bank account:

I feel pretty darn lucky to be in this spot heading into my first full-time job.

Since I don’t have any debt, I’ve started thinking about saving for retirement. I’m only 21, but I’ve done the calculations, and boy, compounding interest is awesome. I’m hoping to contribute 15 percent of my income to my 401(k); as a bonus, my employer matches up to $2,000. Yesterday, I invested $5,000 in a no-load mutual fund that my dad helped me pick out.

I’m playing with the idea of saving up for a house as well. That goal feels so abstract; after all, I still have a couple weeks before I move into my first studio apartment. But as my three-month stint as a shopaholic taught me, having too much “free” money without anywhere to put it is dangerous.

Have any advice, or suggestions for things I should save for? I’d love to hear your thoughts!

Aja Frost is a student at Cal Poly San Luis Obispo who loves writing … and dessert. Follow her on Twitter @ajavuu.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments