A Private Unemployment Insurance Question of the Day

Because federal unemployment benefits aren’t always enough.

A lot of us are entitled to federal unemployment benefits should we lose our jobs. (A lot of us aren’t, but that’s another post for another time.) Those of us who do receive unemployment checks often learn that they aren’t enough to cover expenses—but hey, it’s 2016, all you need to do is buy a little supplementary insurance from a private insurer and you’re good to go!

Let’s Buy Insurance to Cover the Deductible on Our Health Insurance

So now we have IncomeAssure, a private unemployment insurer. The New York Times’ Ron Lieber explains how it works:

Let’s say you live in New York and earn $100,000 annually. The highest possible weekly unemployment check is $425. But your weekly pretax salary is $1,923. Half of that is $961.50. So if you signed up for the maximum benefit from IncomeAssure and then lost your job, you would receive a weekly check for $536.50, which is the difference between $425 and $961.50.

Or, as IncomeAssure puts it:

With IncomeAssure, if you are laid off, you will receive 50% of your former salary, replaced through a combination of state unemployment benefits and our supplemental benefits, instead of the smaller amount your state would replace alone.

Once you start poking around IncomeAssure’s website like I did, you’ll learn that they really mean “you will receive up to 50 percent of your former salary;” as with most insurers, you have the option to request a smaller salary percentage in exchange for a smaller premium.

Are there catches? Of course there are:

- You can’t collect unemployment benefits if you lose your job less than six months after signing up for IncomeAssure. (Lieber and IncomeAssure both note that in this case the company will refund any insurance premiums paid, so that’s a plus.)

- You must wait two weeks after your job loss before collecting benefits from IncomeAssure.

- IncomeAssure only provides 24 weeks of benefits.

So let’s answer the big question: how much is this going to cost you? IncomeAssure offers a semi-opaque answer:

On average, premiums are less than 1% of gross annual salary (trailing 12 month salary, bonus and commission) and depend on your work state, industry, salary and the selected coverage. For example, if you make $75,000 per year, your policy could cost less than $50 per month.

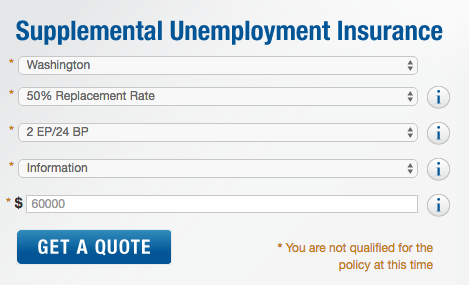

I tried to figure out how much IncomeAssure would cost me, per month, and I learned that I wasn’t eligible for the program:

Technically, I would not be qualified for the policy at all, since IncomeAssure does not accept people who make their income as 1099 independent contractors. But in the parallel universe where I’m a W2 employee at a media company making $60K a year, I’m still unable to apply for IncomeAssure.

So. The question of the day: would you sign up for a private unemployment insurer like IncomeAssure? Are you even eligible? (I’d love to see what kinds of quotes you get, even though I know that those “get a quote” buttons usually mean “give us your contact information so we can call and email you with sales pitches.”)

Also: if you are eligible for federal unemployment benefits, do you already have a plan for making up the gap between benefits and expenses should something happen to your job(s)? This is one of the reasons why I toss 10 percent of every paycheck into my savings account and count the days until I have three months of living expenses saved—that, and the whole “I won’t be eligible for any unemployment benefits at all” thing.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments