Introducing ‘Shadow Flipping’: Just the Latest Reason You’ll Never Be Able to Afford a House

This is Vancouver. Isn’t it pretty? It is. Don’t you want to live there? Yeah, me too. I grew up in Vancouver; my parents are long-time residents, their home just steps from the ocean. Vancouver consistently claims a top spot on those Most Liveable City lists (despite the fact that it’s going to tumble into the Pacific any day now — thanks Mega Quake!). I always imagined I’d one day move back to raise the kids I don’t have, and they could grow up with hair smelling of salt and rainwater.

Housing costs have skyrocketed in Vancouver over the last decade or so (due in part to foreign investors), driving out many of the new-wave hippies who gave the city its laid-back character and creating a prohibitive climate for community-focused residents and young families. There’s nothing new here. However, the Globe and Mail recently published the results of their investigation into shadow flipping, the latest scourge on the Vancouver real estate market.

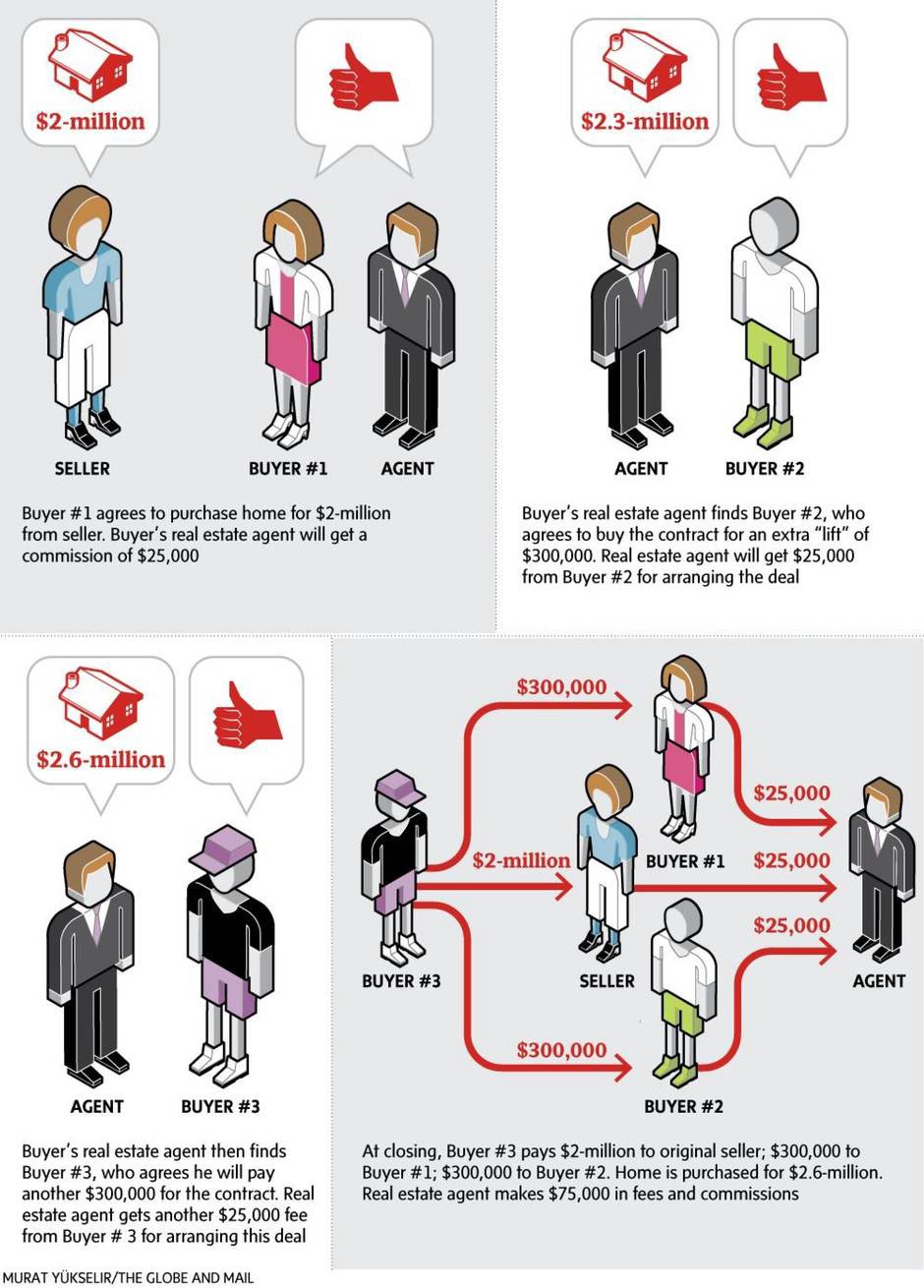

What is shadow flipping? Here’s a helpful cartoon:

Essentially, shadow flipping occurs when a broker or agent arranges a sale and then finds another, higher bid while the home is still under contract — and on and on ad nauseam, driving up the price of the home and collecting the fees. It’s legal — for now — but extremely controversial:

In an already tight market, analysts said, all of this activity ties up inventory, contributing to unhinged prices, as brokers and investors hold property and trade empty houses.

“It does propel the market upward,” said housing-market analyst Ben Rabidoux, who does market research for institutional investors. “They are feeding into the market and making it hotter, while padding their commissions. It’s just so toxic.”

The Real Estate Council of British Columbia has launched a review of the practice, but without real regulatory action, it’s unlikely to have much of an impact. Regardless, barring the bubble bursting in an extreme (and extremely destabilizing) way, I’m never going to be able to afford to buy a home there. And, likely, neither will you.

So I’m curious: what kind of responsibility do you think governments have to regulate housing markets? Do we abandon these cities to their quiet, ghostly fate, or demand solutions that might make them liveable again (albeit only for whomever we’ve deemed should be living there)? And where should I go and raise these kids I still seriously am really not at all close to having?

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments