Market-Averse Millennials, Try Birkins & Legos!

Don’t talk to Chuck. Go shopping instead.

Birkin bags have never decreased in value over the years — whereas gold and the S&P 500 have. The study flatout says it’s a “historically safer investment than a stock market.”

Good luck finding one, though. Part of their appeal is that Birkin bags are a scarce resource, as you might recall from the time Samantha went to great lengths to acquire one on “Sex and the City.”

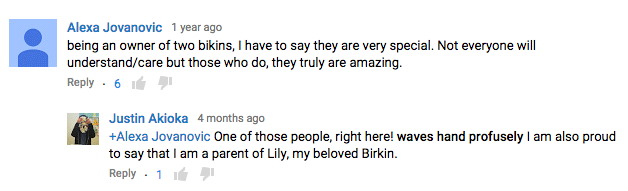

Man, can you believe anything that was popular then is still popular now? Carrie’s taste in accessories has not aged well. Yet these bags have only gotten more in-demand, even as they have also increased in price from $4K to $10K+. This video, which attempts to explain the appeal of the Birkin, is from 2008, but check out the recent comments:

Trouble is, if you feel so emotionally tied to your investment property that you name it, will you ever be able to turn it into a liquid asset? Selling stock is a reasonably unemotional transaction most of the time. Selling a Birkin might not be.

Well, in that case, what about Legos? Why play the stock market when you can play with sturdy, cheerful Danish toys?

investors were able to secure a better return buying Lego sets over the past 15 years than from the stock market, gold or bank accounts, a Telegraph analysis found.

The value of the FTSE 100 is no higher than it was in February 2000, meaning the average annual return to savers over the past decade and half is just 4.1 per cent once dividend payouts are included.

By contrast, Lego sets kept in pristine condition have increased in value 12 per cent each year since the turn of the Millennium, with second-hand prices rising for specific sets as soon as they go out of production. Modern sets are performing even more strongly, with those released last year already selling on eBay for 36 per cent more than their original price.

OK so you can’t actually play with them, or they will no longer be in “pristine condition.” You could enjoy the idea of them, I guess? Put all the unopened boxes in a room and pretend you’re having fun? Then, years later, you can sell them and have actual fun with the masses of money you’ve made. (Or, more practically, as the article advises, any time you want to buy one set, buy two instead, and save the other.)

Millennials as a group, it turns out, may be open to these alternative investments. US News reports that “most millennials (85 percent) said they haven’t yet invested any money in the stock market, largely because they don’t feel comfortable with it.”

The article advises turning that attitude around:

Get comfortable with investing.

Because so many millennials are scared of investing in the stock market (and understandably, since they came of age during the Great Recession), Barrett says it’s particularly important to dive in early so long-term savings can outpace inflation. At the same time, though, she adds that it’s important to have an emergency fund stashed in a safe spot, like a bank account, so you can cover unexpected expenses without reaching for a credit card.

Maybe the answer is a workaround instead! Are Millennials more ready to invest in Hermes and Lego than the S&P? YOU TELL US.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments