Playing The Market & Painting It Too

Playing The Market & Painting It Too: How Sarah Meyohas Turns Finance Into Art

I got to chat with visual artist Sarah Meyohas! The transcript is below.

Hello! I’m so glad this worked. Are you in New York now? In your studio? Do you have a studio? Give us a sense of place, if you would.

I’m in New York. I spend my time in two different places: my studio, which is a big room in an industrial building in Long Island City, and my apartment, from which I run an art space. This summer, I emptied it out, and now live in the constant flux of install and deinstall! That’s where I am right now. Also, there’s no wifi in the studio. I like it better that way!

What is the art space like in your apartment? Does it leave room for you to live aside / separate from your art? Or is that not the point?

The bedroom remains closed. Other than that, there is no furniture and the apartment serves as an exhibition space. I don’t separate art and living. I like to be surrounded, especially by the work of artists that I admire.

That makes sense, given the way you integrate what seem to be two of your abiding interests, art and finance. Let’s back up! Can you tell the people a little about your unusual background?

I went to Penn for undergrad, studying finance at Wharton and international studies in the College. Upon graduation, I went straight to Yale for graduate school, earning a masters in fine art. Undoubtedly, it’s a leap. Essentially, when I was twenty-one, I made the decision to become an artist, which took a lot of gumption in the environment and track I was in. At the time, I didn’t realize finance would go on to play such a crucial role in my artwork.

Since then, finance seems to have become the crux of a lot of your projects — indeed, at times, you’ve turned playing the stock market into a kind of performance art. Can you talk a little about that, about your Golden Enterprises experiment, for example?

What I did with Golden Enterprises — trading it aggressively enough at specific time intervals and then redrawing it on canvas — is objectively a simple and direct move. But there is a lot baked into it. On the finance side, it aims to visualize the representativeness of stock prices — that a stock represents a company, but oftentimes the relationship between the price and the underlying reality is as malleable as any artistic medium. On the painting side, the gesture on the canvas stands as a record of my physical movement. But it gathers depth by its relation to the public record of the stock movement caused by my ownership, virtually. I’m embedding and embodying, if you will. There is also a reflexive nature to the whole enterprise.

Explain how?

Markets are reflexive in that people both judge and participate in the market. For example, if a stock goes up for any reason, that may then affect the fundamentals of the company and it will as a result do well, like a feedback loop.

That being the case, did you feel any ethical qualms when embarking on this project? Fine art doesn’t often have real-world implications but your experiment could have, or did.

There is someone else on the other side of each trade. The drawing is contingent upon the market itself. The real-world implications are important to the piece. Also, I’m buying it up and selling it back down. If anybody is going to make a loss, it’s me!

And did you lose money?

Well there’s this funny thing: I can deduct my art expenses from my capital gains. In this case, they were one and the same!

That’s amazing. I love it. How else have you fused your interests in money and art, or how else do you plan to?

I created a crypto-currency called BitchCoin! True story.

Oh good, I was hoping you would bring that up. Please tell us how BitchCoin came to be and whether it’s been a successful endeavor so far.

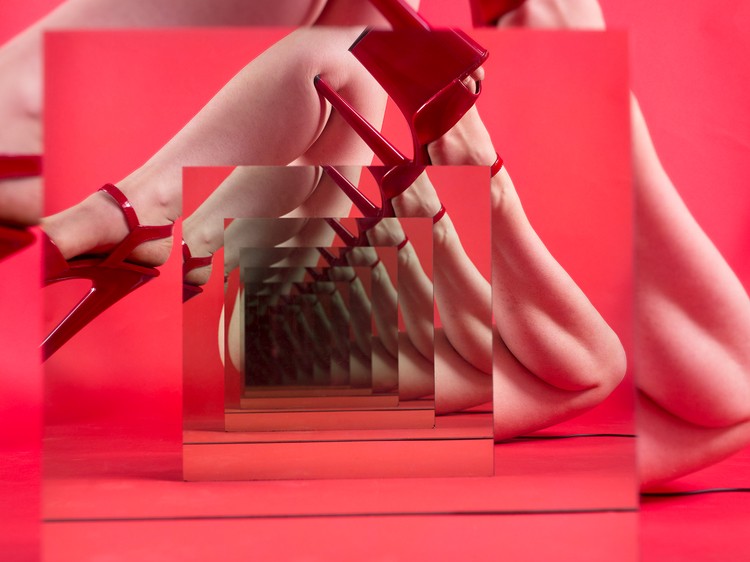

Ultimately, my projects are an attempt to understand value. When bitcoin emerged as a new way of creating value, I was fascinated. I wanted to turn a gallery into a mine — as an investigation into space, the imaginary, value. From there, I decided I would create my own cryptocurrency. To make it valuable, I backed it at a fixed rate of 25 square inches of my photographic editions per coin. From there, the analogy of photography and money, both having value based on printing took root. The photographs fed right back into the piece by being titled Speculations, and being taken with two-way mirrors to create space ad infinitum by reflection.

As a young artist, I was entering the art market by providing a financial instrument. That seems to be more appropriate today than say, starting a factory like Mr. Warhol.

How has your work been received so far by finance folks and by art folks? Do people get it? Does one community seem warmer than the other?

It was a surprise to me that both are equally enthusiastic about it! For both communities, it allows an entrance into another world. For both, part of the work appeals to a language and form they understand, and then takes it to a new place.

Looking at finance from a philosophical angle seems fertile to me right now. The market is a place of perfect competition where people meet in a constant exchange that is then tracked as price over time, as a line. It’s a form of being, through judgement and position, in time.

How many BitchCoins are in circulation, roughly? Were they all bought by finance types?

There are very few in circulation. I only released one edition of prints. There were originally 200 in circulation, and then 25 got converted into a print. So there are only 175! I will be releasing more eventually — in another show probably.

They seem to be an explicitly feminized currency, what with the name, the lipstick-ed icon on the website, and the photograph “Speculation,” to which they are connected. What made you decide to do that?

The exchange of women and their images seems fundamental to capitalist societies. With Bitchcoin, this is still the case since it is the exchange of bits of my image. But the currency is mine. I’m giving the audience a lot, but then ultimately retain control.

That seems to be true of the photograph as well. It’s revealing but only of what you want to have revealed.

Exactly. Also, generally in the speculations, it is whatever is at the margin that is then repeated and expanded into. I almost think of it as a levered image.

There is a motif of mirrors in a lot of the visual art, too. Do you think of mirrors as feminizied? And is the stock market performance art sort of a way of holding up a mirror to that system?

In the stock market performance, I am enacting a mirroring of sorts — between the screen where google finance shows what I’ve done and the painting where I then draw the line. I don’t think of mirrors as feminized. I think of mirrors as an analogy to the way value is formed. In an exchange, one is always in the place of the other. A price is akin to holding a commodity up to a mirror.

That’s interesting! I think of a reflection as being more objective, whereas anything’s value will vary widely depending on context.

That’s true. But a mirror also allows an object to go from three dimensions to two dimensions. Without forsaking detail or clarity, there is a significant process of abstraction going on there that is similar to the way the financial market has to make lots of realities equivalent to each other.

Hm. Perhaps! Do you foresee a time when you will pursue a traditional day job in finance? I think I read that, for now, you’re still finishing up your MFA.

I finished my MFA in May. I never foresee anything or set any expectations. So, who knows …

For now, are you making a living off of your art?

It’s a labor of love. I don’t even think of it as making a living. It’s just living. To be more direct, so far I support myself with other investments.

In stocks and bonds? Or in real estate etc. as well?

Mostly stocks, though also dabbling in some start-up and distressed private equity investments.

Did Wharton teach you how to do that? Or did you go into college already knowing how? How did you get started investing? How did you get started investing?

It’s funny, in the classes I took at Wharton, they teach you a classical view of markets. In the intro to finance classes, it’s assumed that markets are efficient! So, while I did learn the basics at Wharton, it was mostly self-taught. I just read a bunch, and talk to people. I’m not a day trader, so it’s more fundamentals. I got started in college with a gift from my grandmother.

Did you have family members in finance?

I have three big brothers and they are all in finance! But they don’t really trade stocks.

Oh wow, three big brothers in finance? Your Thanksgivings must really be something. Do you all get competitive?

Not only three big brothers, but ten nieces and nephews! Nobody really gets competitive … I’m not even sure what that would be like! Everybody is really supportive.

Of each other and of you?

Yes! At first, they didn’t really get what I was doing, and sometimes they still don’t. But then other times, they get really excited and that makes me happy!

Aw, of course. What’s your best advice for young people who want to get started investing?

Being young is the time to take a risk. It’s also a time to educate yourself and be open to learning a skill. Investing is something that follows you for the rest of your life, so learning to cultivate judgment and familiarity is important. If you can, don’t just put it in some mutual fund. Be proactive, though within reason.

Heh. That’s tricky, though, and often the opposite of what we advise — but then, we’re mostly making suggestions to folks who don’t have the time or understanding of the market to be as active as they would need to be.

Yes, of course. It depends on how involved you want to be. I guess my advice is just not to be passive. Don’t close your eyes to it.

What about for your retirement and other longer-term accounts? Are you less active with those?

Truth be told, I don’t have a 401-k. I finished graduate school less than a year ago, and since I am not a salaried employee, I don’t even think I can get a 401-k. I haven’t really looked into retirement yet. I know I should…

I understand! I feel like it takes people a little while to ramp up to it. Any last thoughts about art or finance, or the ways you find that, or make them, overlap?

Gold nanoparticles. That’s the next project. 😉

That is intriguing but what does it mean?

It means gold so small you can’t see it directly. It means creating color through a phenomenon called surface plasmon resonance that relies on the shape of the particle. It means … you’ll see!

I’ll see indirectly. 🙂 Sounds great. Thanks for chatting with us!

Thank you!!!

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments