Yay, More Mommy Wars! Now With A Tax Twist

If the Mommy Wars were a billion-dollar movie franchise, we’d be on Episode VIII right now, or maybe getting some indie director to reboot them all from scratch again just for the fun & profit. So you’re forgiven if you cannot handle another installment right now. Here, read this instead: a blog called The Worst Things For Sale. You’re welcome!

Everyone else ready to get aggrieved? Good!

It is understood that parenthood is hard, much harder than we tell people it is, and folks who engage in it successfully — i.e., without doing irreparable damage to people or property — deserve prizes.

There will be days where you will find yourself amazed that you have made it through the day without actually giving your child away to the nearest stranger, no matter how clear he’s made it that he hates you and wants to destroy your happiness. You deserve an award for this. There isn’t one, but just know that you do deserve it.

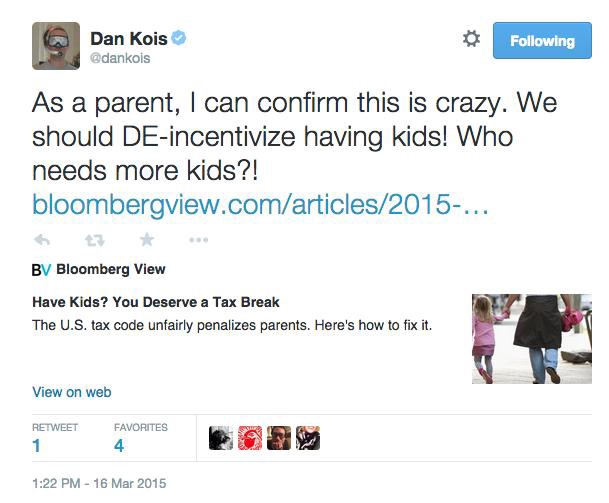

But do those folks also or actually deserve (greater) tax breaks? Bloomberg editors argue yes:

each little one costs roughly $245,000 to rear, on average, not including college. Parents who undertake those costs aren’t just raising the next generation of upstanding citizens: They’re also subsidizing their childless peers. The tax code should do a lot more to help them out.

Entitlement programs such as Social Security and Medicare depend on younger generations of workers to contribute payroll taxes. Nonparents don’t have to pitch in for all the diapers and iPhones and orthodontics required to raise those workers, yet they’re entitled to the benefits the youngsters eventually pay for.

That’s not only unfair, but it also creates a perverse incentive: For a given individual, generous entitlements discourage procreation by reducing the need for a child’s help in old age. Yet sustaining those benefits requires the country as a whole to produce more kids. The fertility rate in the U.S. is now at an all-time low, and Social Security, according to one study, has been responsible for about half its decline. Meanwhile, as you may have heard, the baby boomers are retiring.

Even some parents are not persuaded by this logic, as attractive as it sounds.

Instead of tax code changes that could be here one year and gone the next, I myself would prefer structural and societal changes in the way we support parents, starting with paid parental leave — “The only other countries on the planet not to have any paid leave at all are Lesotho, Swaziland, and Papua New Guinea” — , some kind of child care subsidy, and universal pre-K. So many of my friends, who are members of my privileged, educated cohort, are in their 30s and in relationships and are still holding off on having children because of cost. I can’t blame them. In an ideal world, I probably would give Babygirl a sibling, but as things stand, I can barely afford her.

Also, Slate decided to republish Allison Benedikt’s cheerfully inflammatory piece about how if you send your kid to private school you are a bad person, so feel free to argue about that too!

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments