The Windfall Theory of Personal Finance

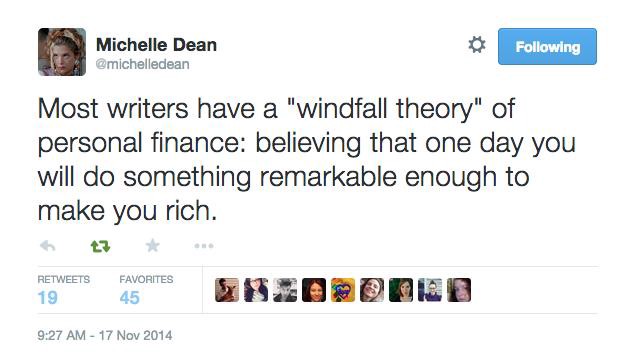

Inspired in part by the Hedgehog Review essay, “Falling,” about how Pulitzer Prize-winning journalist William McPherson descended into poverty, Michelle Dean tweeted the following sentiment:

The response from the Twitterati made it clear that she had struck a chord with her audience. “Shh, don’t say it out loud!” said one. “I thought it was just me,” said another. Ben Yagoda astutely pointed out, “I’d replace *writers* with *people.*”

Because part of what does in McPherson, by his own account, are the kinds of mistakes people everywhere make, including an instinct to over-rely on his pension. Pensions are like leprechauns: it takes hard work at this point to catch one, and even if you do, you’re likely to be disappointed when the pot of gold is the depth of a cereal bowl.

The pension would start twelve years later when I was sixty-five. What cost a dollar at the time I accepted the offer, would cost $1.44 when the checks began. Today, what cost a dollar in 1986 costs $2.10. The cumulative rate of inflation is 109.7 percent. The pension remains the same. It is not adjusted for inflation. In the meantime, medical insurance costs have soared. Today, I pay more than twice as much for a month of medical insurance as I paid in 1987 for a year of better coverage. My pension is worth half what it was. And I’m one of the lucky ones.

I was never remotely rich by what counts for rich today. (That requires a lot of zeroes after the first two or three digits.) But I look through my checkbooks from twenty-five and thirty years ago and I think, Wow! What happened? It was a long, slowly accelerating slide but the answer is simple. I was foolish, careless, and sometimes stupid. As my older brother, who to keep me off the streets invited me to live with him after his wife died, said, shaking his head in warning, “Don’t spend your capital.” His advice was right, but his timing was wrong. I’d already spent it. He sounded like the ghost of my father. Capital produces income. If you want to have an income, don’t dip into your capital.

Lots of good lessons there, and there are more in the piece as a whole. He also addresses the white privilege that continues to protect him. He does not engage with the dichotomy of Poor vs. Broke, choosing merely to define himself as “poor.” It’s his right to identify with the word if he chooses to but there was a lot of unpack there, if he had had a mind to do it. At what point does a person segue from Broke to Poor? What was the tipping point for him? Or did he not consider the nuance of that particular word?

The magical thinking aspect is of particular interest to me. If artists, writers, and creative types in general didn’t imagine a windfall in their future, they might stop altogether. They have to hope for a MacArthur-like windfall, at that, since as we’ve established even a Pulitzer will not protect you; it’s “fancy watch” money, not “set for life” money. Still, how could they think otherwise? There are very few avenues to a stable middle-class existence; either you make it or you give up, especially now, with inequality getting even worse. (“Inflation-adjusted earnings of the bottom 90 percent of Americans fell between 2010 and 2013, with those near the bottom dropping the most. Meanwhile, incomes in the top decile rose.”) Get rich or get out. It can feel like those are your options, whatever your profession. And getting rich means getting lucky first.

Human beings are notoriously bad at learning from other people’s mistakes. We think things will be different for us, but we can’t count on luck to come through. How much luck, after all, did McPherson have and, you could argue, squander? He got windfalls, several of them. They didn’t suffice.

Hope for a windfall, but ready your fallback. The only safety net you can really rely on is your own.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments