Checks and Balances: One Lady’s Haphazard Finances

by Heather Sundell

I know how to balance a checkbook because my mother taught me how the day I opened my first checking account in the spring of 2003.

At 17 years old, I had already been an active member of the workforce for two years, and my new part-time job at Steve Madden required direct deposit. My mother took me to our local — and now sadly defunct — Washington Mutual Bank to help me open the account that I still use today (the bank filed for bankruptcy and was acquired by JPMorgan Chase).

Technically, you need to be 18 to open a checking account, but the bank was willing to bend the rules a few months early if my mother agreed to be on the account as a cosigner. With my new debit card and checks in the mail, my mother took me aside to show me how to use the transaction register that came with my temporary checks.

“This is how you can keep track of your money,” she explained. “Whenever you make a purchase or cash withdrawal, record it. And, whenever you make a deposit, you should also record that too. That’s how you know how much is in your account at all times, and it let’s you easily find any discrepancies when your statement comes every month.”

I nodded. Of course, it was all very simple and easy to understand. I was eager to start my real grown-up financial journey, filling out my ledger with diligence every single day for the rest of my life. I was going to write so many checks for so many purchases.

Before I left WaMu, I penned my deposit, withdrawal and new account balance into the booklet. I was going to be great at this.

Shortly thereafter — like, later that day — I used my first temp check to buy a pair of Rainbow sandals I had been obsessing over at a Huntington Beach surf shop. I wrote the check slowly, trying to remember what to include on each line, and doing my best to write “Fifty Dollars and no cents” in legible cursive. I logged the debit into my transaction register and put it away in my purse, feeling very grown-up.

I used the register a few more times before letting it grow dusty in the corner of a desk drawer. Once my debit card arrived, recording every transaction became tedious, especially for a teenager, so it ceased completely. Writing checks became a rare occurrence.

Besides online banking.

Since abandoning my first transaction register, I have sadly eschewed my mother’s well-advised financial tactics in favor of adopting my own brand of casual haphazard finances. For over a decade now, my financial management has mostly consisted of getting a tight pit in my stomach while logging onto my accounts a couple times a month to see how much money I have left until my next paycheck, whether or not I over drafted, and what the minimum credit card payment du jour is.

I rarely write checks beyond rent. When I do, it’s basically illegible and, until recently, boasted an address from three apartments ago. I just ordered a new set of checks (it took five years to go through the last batch), and was struck by the transactional register placed at the bottom of the box, as if it were a surprise gift.

Oh, I remember you, I thought as I looked through it like an antique relic. How quaint that they still give you these.

I haven’t gotten the tight pit in my stomach when I log on to view my accounts in some time. I’ve been fortunate enough to have reached the age of 29 and, subsequently, relative financial stability. I seem to have gotten my shit together enough to have an IRA, a portfolio, and a savings account — all of which I contribute to regularly — and both an accountant and financial advisor to help me understand all the hard maths.

And yet, despite all those adult financial decisions, I still manage my money the exact same way that I did 12 years ago. How is that possible?

I guess it makes sense. I’ve grown up with online statements reflecting instant changes, relied on constant access, and received text message alerts for possible fraud. I haven’t had to proactively DO anything in regards to managing my cash flow; technology did it all for me during the time I became a financially independent adult. The technology is only growing more advanced.

Surely this is a generational thing. I’m a curmudgeonly older Millennial who insists on taking paper checks to the bank for a deposit instead of using the convenient app at home. We all have our old people sticking points and, I thought for parents, it would have been a long time ago if mine was app deposits. However, that’s not the case.

After interviewing my almost 70-year-old father on his financial management, I found that his system (or lack thereof) was exactly the same as mine. The apple doesn’t fall far from the lazy tree, apparently. He said he hadn’t filled out a transaction register in years and, based on the orderly chaotic state of his office, who knows how much of that he actually did when it was the only way we tracked our spending.

Then I talked to my mom. “Well, no wonder,” she said. “I was the one who managed the checkbook.”

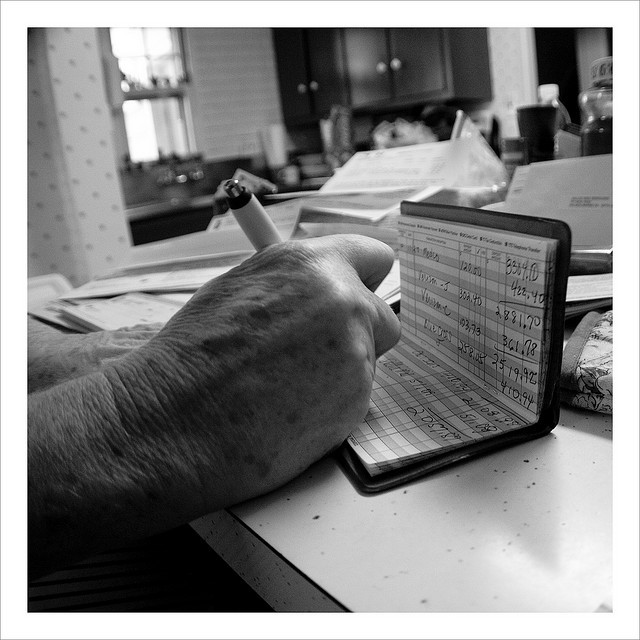

Apparently she was always the financial organizer in the family and, guess what, she apparently still is. When I asked her if she still used her transactional register, her answer was, “Absolutely.” She told me that she still manually records every purchase, deposit, and withdrawal because “it’s just too easy to forget if you don’t write it down.” She doesn’t even check her statements online.

I have to assume there’s a common ground between the arbitrary way I have handled my money and the time-consuming, unnecessary process of *gasp* writing it all down. But, maybe there isn’t and, like my accountant told me (after I begged him to tell me how to do my taxes “right”), there’s no right way to manage your money; it’s all very personal and individualized.

But as far as checks go, I just hope that paper checks don’t ever leave us completely, not in the near future anyway. Because, no matter how old I get, writing a check will always make me feel like a grown-up. I have a brand new stack of them to get through.

Heather Sundell lives in Los Angeles. This is her blog.

Photo: Michael

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments