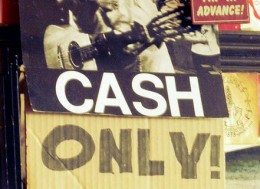

“Shortsighted, Cheap, and Unethical: Cash Only.”

A retail expert opines on Gothamist that “cash only” businesses are a racket, and a contemptuous one at that.

It’s not optional, guys: you need to take cards. Which is why if the idea is cost savings, you’re looking at a bad business with a terrible approach to its customers: basically they don’t give a crap about you, just your cash. And yes, if a restaurant doesn’t take cards they are stealing money from the state (no paperwork means no sales tax trail). You’re giving the state money, their duty is to deliver it to Albany quarterly. Instead they steal it. Pretty awful? Most business people suck is why. Shortsighted, cheap, and unethical: Cash Only.

Gothamist concurs:

A place that doesn’t take cards is bad, but a place that doesn’t take cards and has an ATM right outside — that’s just straight up evil. It’s like “thanks for patronizing our establishment, let me kick you in the crotch on the way out!”

There was a famous cheese shop in the East Village when I lived there, ten years ago, about which you had to know two things: it had amazing prices — like, “Did these cheeses fall off a truck?” kind of good — and it was cash-only. Well, great. Now I have to wonder if it’s a front for the mob.

Lots of small businesses around there were like that. I didn’t think about it much, in part because I assumed those two traits, affordability and not taking cards, went hand-in-hand, and in part because my father drilled into me that you don’t leave the house without money in your wallet, so I could buy delicious, inexpensive gruyere when I needed to.

Joe Coffee, a chain of indie coffee shops, was cash only for its first six years of business and did fine. Then, according to CNBC, its owner recalculated — for purely practical reasons:

Six years in, Rubinstein began to notice a shift in customer behavior. “We started reading our Yelp reviews — 75 percent of the negative comments about Joe were about us not taking credit cards,” he said. “We were losing a lot of sales in terms of people not having cash and going to a competing coffee shop but also people spending less money who wouldn’t buy a $17 bag of coffee [beans] or a $75 grinder.” Joe started accepting credit cards at its new outpost in 2011, a shop near Columbia University, where customers — mostly students — tend to pay with debit cards. The experiment went well enough that as of mid-October, nine in 10 Joe Coffee locations now take plastic. “Welcome to 1999,” the company tweeted on Oct. 23. “All of our stores (other than GCT) now take CREDIT CARDS! Our Yelp ratings about to skyrocket #sorryittookustenyears,” it said. …

Rubinstein’s initial reluctance mirrors that of a broad swath of U.S. merchants. Fifty-five percent of the nation’s 27 million small businesses don’t accept credit cards, according to Intuit, the Silicon Valley software firm that develops financial and tax prep solutions for small companies. By not accepting cards, those 15 million businesses are missing out on $100 billion in sales annually — roughly $7,000 per company a year in either new sales or sales that go to competitors that do accept cards, said Intuit

It didn’t occur to me that the East Village Cheese Shop, or Joe, or the 55% of small businesses that avoid dealing with cards might be cheating on their taxes. Of course, some of them might. Some of them might simply have narrow profit margins. Considering that consumers buy more if allowed to use cards, it’s quite possible that stores would make more in the end, even factoring in taxes and fees. So while I respect Gothamist’s rage, I think it might be a bit misplaced.

Besides, if the connection between criminality and being cash-only were 1:1, wouldn’t it be pretty easy for the taxman to know where and how to crack down?

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments