The Year I Saved $10,000

I want to share stories from people who saved $10K in a year. Whether you do it every year or did it just once, it’s time to talk about serious saving. If you have a story to share, email me at dieker.nicole@gmail.com.

The year I saved $10,000, I didn’t do anything differently.

That’s not completely true.

For starters, I finally had a job that paid more than $50,000. In 2009, that was supposed to be the “magic number;” the salary at which you stopped having to worry about being broke and could start focusing on being happy. Additional salary increases weren’t supposed to make you more happy; they were just more money.

(It’s worth noting that the first time I read about the “magic number” was in 2004, when Penelope Trunk called it at $40,000; in 2010, Princeton did research to determine that the actual magic number was $75,000. Who knows what it would be today.)

So my salary was different. That’s really the determining factor here. But I also did a few things differently myself.

I was already familiar with the “broke student” lifestyle, so much of my life didn’t change. I cooked up to 95% of my meals at home, including the lunches I brought to work. This was proper cooking from ingredients: rice, beans, lentils. I baked my own bread. I walked everywhere, I didn’t buy lattes, I didn’t buy books. I knew how this type of life worked.

I invested in some new work clothing, as well as Ikea furniture for my new apartment, and then, once I decided I had the basics of what I needed, set myself a hard limit: $150 in spending per week, to include all non-rent spending (if I remember correctly, I even had to pay utilities out of this weekly $150). I wanted to pay off my debts and get an emergency fund, and that is what I did.

As Emily Kaye Lazzaro noted earlier this week, putting a hard cap on your spending is hard.

It helped that I didn’t have any friends. I was the person who made excuses about not going to happy hour, or the person who went to happy hour and sipped water. (At one point I was trying to explain it to a coworker and I was all “I can’t just spend $20 every time someone thinks it’s a good idea to go to a bar, okay? I’m trying to save!”)

I didn’t have any friends, and my lifestyle didn’t help me make any.

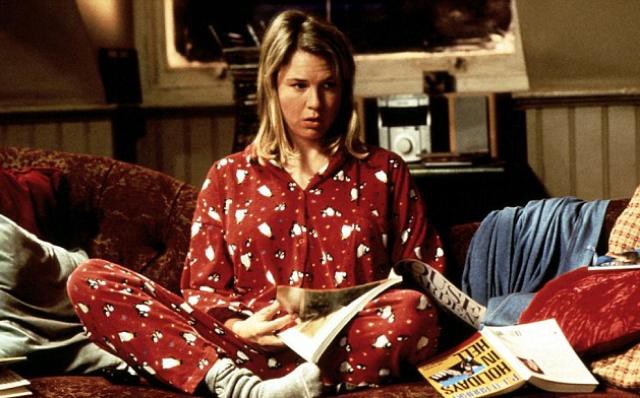

I spent most of my evenings at home, alone, reading library books or surfing the internet. I didn’t even pay to rent DVDs — it was at the library or I wouldn’t watch it. I read every single personal finance book or blog I could find, surrounding myself with proof that I was making the right decisions. I wondered if this would lead to early retirement. (I did the math. It wouldn’t.)

When I think of the year I saved $10,000, I know I did a very good thing and I was very glad to have the money when I needed it a few years later.

I also think of being lonely.

I probably could have figured out a way to save $10,000 without being lonely. I just didn’t figure it out, that year.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments