Ask A Human Who Actually Practices GTD (‘Getting Things Done’)

Here is a real tweet that I really tweeted yesterday:

My inbox may be zero, but my GTD list is spiraling out of control. Time to reconfigure my Horizons of Responsibility or something. #GTD

I meant every word of it.

I’ve been practicing GTD, or David Allen’s Getting Things Done system, since 2008. That’s well over 300 Weekly Reviews. An uncountable number of Ubiquitous Capture Devices. The regular, systemic processing of my Inboxes to Zero.

What does this have to do with personal finance, you might ask? When I was working as an executive assistant, practicing GTD didn’t have all that much to do with finance except for the part where it helped me pay my bills on time. It was only when I switched to the freelance world that GTD became an essential part of my money management.

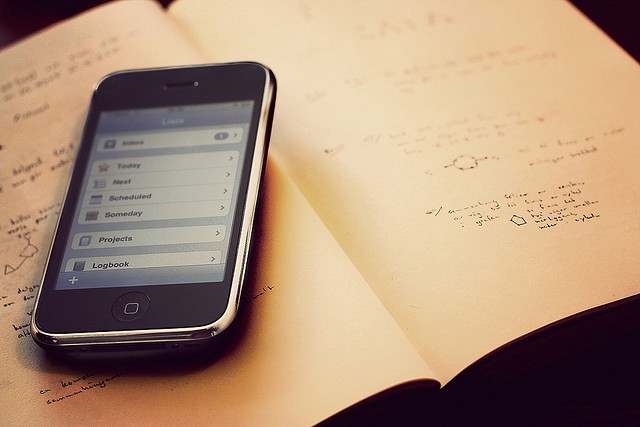

It’s probably time for a quick update of what “GTD” is. At its core, “practicing GTD” means sorting through all of the various inputs that come at you every day — email inboxes, Twitter feeds, online chats with editors, personal conversations — and isolating every task that you have agreed to complete onto a single list. Then, you organize the list into completable chunks of action items, and you get things done.

(There’s a bit more to it than that — I mean, I did use the words “Horizons of Responsibility” above — but you don’t have to worry about that until you get really, really serious about the practice. And yes, I keep calling it a practice, like yoga.)

I could not manage my freelance life without GTD. If I had to wake up every morning and remember what I was responsible for writing, or go back through my email every time I wanted to look up revision requests from an editor, I wouldn’t be able to complete as much work during an actual day.

Likewise, when financial security hinges on completing as much writing work as possible, I need to remove every single potential barrier to completion. This includes “who haven’t I pitched recently?” (that’s scheduled and on the list) and “what three points do I need to hit in this piece?” It also includes the very important sub-list: “who still owes me money and when do I need to remind them?”

I also know that GTD helps me save money because when everything’s on the list, the times in which you spend money are also on the list, so you can prepare for them. Like, all my bills are on the list, and so are all the groceries I need, and anything else I want to buy goes on the list first (and, often, doesn’t get purchased because a few weeks later I decide I don’t need it anymore). GTD lets me do all of those goofy financial hacks that you read about, like “put a purchase on a list and wait 30 days to make sure you still want it.” Yes, I am a human who actually does that.

There’s also the weird brain-thing that happens when you put all of your open mental loops onto a single list: you literally stop thinking about them until it’s time to go to the grocery store and you open the list to see all of the groceries you need in a single place. I don’t know how to remember something without writing it down anymore. (Also, the concept of grocery shopping without a list — like, you just wander through the aisles and guess? — seems almost frightening.)

David Allen’s original book Getting Things Done was published in 2002, and there’s already a certain dated-ness to the GTD concept, as if we’ve all moved on to smartphones and apps and new productivity fads. But I still do my Weekly Review, every week.

If you have questions about how you too can welcome GTD into your life, I am happy to answer them. We can start with “the reason I wrote this post today was because it has been on the GTD list since y’all requested a GTD post, and now I can check it off the list and complete something else.”

Photo: Johan Larsson

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments