Dear Bank: I’m Breaking Up With You

by Joshua Michtom

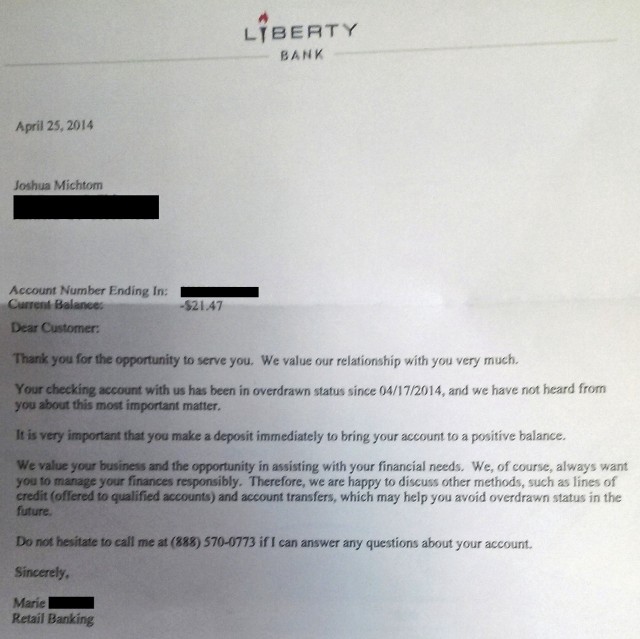

Dear Marie:

It was with mixed emotions that I read your letter, in which you wrote that Liberty Bank values its relationship with me. I must confess to some serious misgivings concerning that relationship and the bank’s true feelings.

Do you recall an incident from about a year ago, when someone from the bank called me to tell me the security of my account had been compromised and I had to open a new account and move my money over to it? It was springtime, I think — a warmer spring than this cold, dreary simulacrum of the season that we’re suffering through now. I trusted the bank then, so I changed accounts as requested, and all was well, barring the annoyance and paperwork, and having to wait two weeks for new checks. (Do you understand how much I hate paperwork? So much.)

But shortly thereafter, I found out that actually, my account wasn’t compromised. It was just that my ex-wife deposited one of those credit card checks, and someone at the bank somehow concluded that this check, which had her name on it (we never even had the same last name!) was a forgery of one of my checks because it had an address on it where I used to live (because we used to be married!). How do you even make that mistake? It didn’t have my name on it! No matter — there was no harm done, aside from the fact that my ex-wife’s confidential account information was somehow shared with me in the process, which was really no big deal because she and I are on good terms. (The kids are doing OK with the divorce too, in case you were wondering. It’s a work in progress.)

And do you remember this past summer, when I contacted the bank because two of my checks had bounced even though I had sufficient funds? I talked to some very nice folks at the Middletown branch, and even showed them the letter I got from the Department of Motor Vehicles, indicating the date when the check had bounced and the fact that I had to pay a $35 fee. I also told them about a check I wrote to my ex-wife, which also bounced within a week of the DMV check. After an investigation, they told me that they couldn’t figure out what had happened, so Liberty Bank wouldn’t refund my $35 unless I could provide a specific letter from the DMV giving more information and get the canceled check back from the DMV, which, ha ha, right. Do you even understand what it would entail to get that letter? Have you ever called the DMV?

I could kind of understand the bank’s unwillingness to take responsibility if it were just one bounced check — I mean, maybe it was the DMV’s mistake, right? (Or maybe you thought I was working some complicated hustle to squeeze Liberty Bank for an extra $35?) But two in the span of a week? And my ex-wife has an account at Liberty too, so my check bounced when she tried to deposit it IN YOUR BANK. How could this not be your fault?

More importantly, why wouldn’t you just refund me the $35 as a matter of good customer service? I mean, how long had we been together at that point? Years. But you didn’t. In fact, when the lady who investigated the problem called to tell me she couldn’t figure out what had happened, she asked if I wanted to write a separate letter to some higher-up in the bank’s administration. When I said I was too fed up to waste any more energy on $35 and would be closing my account, she didn’t even transfer me to some kind of customer retention specialist or anything. She just said, “I’m sorry you feel that way,” and hung up. Is that how you treat a valued relationship? It felt like that Spanish girl I dated in my freshman year of college — I mean, the one I thought I was dating, until she unceremoniously said to me, “What, this? Between us? This isn’t anything.” (Except, of course, she said it in her marvelous, smoky voice, and in her Galician Spanish with its slinky sibilance, which made the whole thing hurt even more.)

So I resolved to leave Liberty Bank. Of course, changing banks is a process even more onerous than changing accounts within a bank (a fact I know thanks to the aforementioned Liberty Bank mistake), so I left my Liberty account open while I switched over my direct deposit and changed all my automatic bill paying and got my new checks. By now, I thought I’d switched everything over to my new bank, but the dry cleaners, whom I visited for the first time in a while two weeks ago, had my old debit card on file and charged it without consulting with me, and I guess it went through.

What upsets me, in addition to, you know, everything, is that the only time you can be bothered to sit down and tell me how much you value our relationship is now that I’m overdrawn by $21.74. When you guys made me change my account and my checks and all my payment information because of your screw-up, there was no apology, no free toaster, nothing. (Do you remember when banks gave away toasters to encourage people to open accounts? I used to see those ads when I was a kid and I think, “Man, you could open the no-fee account with fifty bucks, get the toaster, then withdraw the money, close the account, AND SELL THE TOASTER!” I guess that just goes to show you that children don’t understand the relative values of time and money. But I digress.) And when you somehow wouldn’t honor the checks I was writing, it was worse, not only because I ended up having to pay the DMV an extra $35, but because it happened when I was just getting my finances in order after a long period of instability and legitimately bounced checks. There was something particularly painful about the fact that even with $1,500 in checking, I was somehow bouncing $200 checks — as if I were destined to to be insolvent no matter what, a fiscal Job. The bank couldn’t have known that, of course, but still, an apology would have gone a long way, or maybe a free home telephone shaped like a football. (Remember when Sports Illustrated gave those out with subscriptions? I really wanted one when I was eight.)

I expect that all of this will fall on deaf ears. If I’m lucky, you’ll reply with some letter in which you explain the bureaucratic impossibility of refunding my $35 bounced check fee without proof that the bank was responsible, and tell me how that incident has no bearing on my current debt to you of $21.74, a debt legitimately incurred by me. You’ll reiterate how much the bank values its relationship with me, but warn me that if I refuse to pay the $21.74, you’ll be forced to refer the matter to an outside collection agency. I will read your letter wistfully and be reminded of the letter I got from the General Mills cereal company when I was 11. I had written them to complain about the Kix slogan, “Kid Tested, Mother Approved,” and how it was sexist and didn’t reflect my reality as a child being raised by a single father. General Mills responded with two pages of convoluted business-speak about target demographics and daytime advertising markets, which made my 11-year-old eyes glaze over. Of course, they never changed the slogan, but at least they had the good graces to include a couple coupons for free boxes of cereal.

So, Marie, it is with some sadness that I must tell you that I no longer value my relationship with Liberty. I liked the bank a lot. The customer service, especially at the West Hartford branch, was always top notch. I also liked that the flame logo on the checks looked like the Wu Tang symbol when I turned it upside-down. But I’ve moved on. You may close my account and refer the $21.74 debt to a collection agency, at which time I will pay it, savoring the small modicum of satisfaction that comes from knowing that Liberty Bank will receive only a fraction of the money.

Regretfully, I remain,

Josh Michtom

Josh Michtom is a public defender in Hartford, Connecticut. He spends way too much of his spare time decorating his children’s school lunch bags.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments