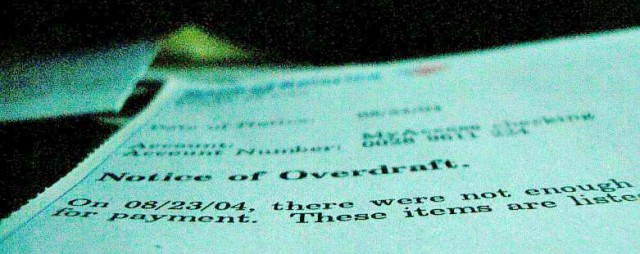

How Can I Prevent Myself From Overdrawing My Account?

A reader writes in to tell us about her banking experience:

This isn’t really WWYD, but a “What I Did Do.” I thought I would send this in as it might help other people when faced with a similar situation.

I forgot about an automatic payment which wiped out my checking account two days before my paycheck came in, and in that void I swiped my debit card five times which resulted in five overdraft fees of $35 each. Of course I had plenty of money in my savings account, but since I don’t sign into my bank account every day (should I be doing this?), I didn’t realize in time to transfer the money.

After angry-crying at the bank and those around me to cover up that I was actually extremely angry at myself, I called the bank and (very calmly) asked that they waive the fees. I have been a customer for over seven years and have never over-drafted before. They waived two of the fees, bringing the penalty down to $105. I got back $70.

I also asked if I could start receiving alerts when this happens — of course I check my email constantly and if I saw I had one overdraft, then I could easily go and transfer the money. The customer service rep said they did not offer this, but gave me two options: 1) I can sign up for Overdraft Protection, which will automatically transfer money from my savings into my checking account to cover the expense, for a $12 fee each time this occurs. 2) I can set my debit card to decline at the register in the event of insufficient funds.

I opted for option 1 in the event that I’m stranded somewhere and need money. I think the key here is speaking calmly and politely to the representative on the phone. Recognize that you are the one who made a mistake, and you need their help. I have worked at a call center before and you can bet your bottom dollar that if you were rude to me I was much less likely to go that extra mile to help you.

What would you do to avoid this situation in the future (besides just like being responsible about projecting your expenses)? Any apps that could help here? — N.

•••

N., thanks for taking the time to write in and tell us about your experience!

I check my bank account balance on a daily basis, but this habit is mostly due to the fact that someone once duplicated my debit card using a skimming device and withdrew everything I had in my bank account, and I’m paranoid that it might happen again.

I currently bank through Chase, which has allowed me to set up several email notifications: When a deposit clears my account, when a withdrawal over $100 is made, when my balance hits under $500 — among other alerts. I set all of this up via my account online, so I’d double check to see if this option is available to you (I know Bank of America offers low-balance text message or email alerts too, as does Citi and many credit unions). Because of this, I’ve been fortunate enough to avoid over-drafting. If this isn’t unavailable, I think overdraft protection is a fine alternative.

You don’t need an app if you’re taking a few minutes to check your balance on a daily basis. Being highly aware of my balances has also helped me keep my spending in check. When I’m out and facing the question of “can I afford this?,” having my balance fresh in my mind makes it easier to answer yes or no.

Photo: ryan

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments