The Answer to Getting Out of Credit Card Trouble: A Spreadsheet

by Zachary Slack

When I clicked the “sure, I’ll pay back this $55K” button on the student loan site, I had $10K in credit card debt. I also had no idea that I had racked up $10K on my credit cards.

I remember waking up in the middle of the night and thinking, “What do I actually owe?” My debt was spread across three cards, and I made regular, minimum payments on them.

It turns out I had much more debt than I thought, and when I discovered the exact figure, I went through the Kübler-Ross stages of grief: screaming, emotional eating, retail therapy, crying on the phone to the relative least likely to tell my dad.

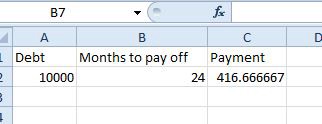

And then I made my first Excel spreadsheet. It looked a little like this:

I couldn’t handle $416.66 a month, so I decided to go with $300. As a 21-year-old just finishing college, this was an incredible amount of money. I had also just signed on to two years of graduate school for an even more incredible amount of money. I had a good outlook on the situation, though: $300 would be a good training-wheels amount to get used to — after all, I’d be giving up that kind of money each month for the next 27 years.

I worked two jobs and often took on freelance work to make these payments while soaking my brain in the graduate school Kool-Aid. I sacrificed two pretty nice tax refunds, two Christmas’s worth of cash gifts, and two summers to pay off that credit card debt. I did it, and it took three fewer months than I planned. I danced and wasn’t even drunk. I will never carry credit card debt again. I calculated the interest I paid while in guerrilla debt-crushing mode: $1,865. That is way too many martinis to experiment with debt again.

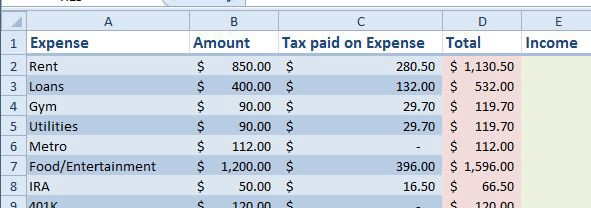

I am now in the second month of making student loan payments. I budget for them, and watch the balances like a hawk. I’m still accruing more interest than I pay (wow, great system we have going here), and I try to match that and pay at least $50 on the principal, but it’s difficult. I won’t be able to do it every month (read: Christmas). I moved to Manhattan immediately after ripping my master’s degree from the dean’s hand, and so I don’t have the luxury of extra cash (I just had that heart-warming conversation with my family about how stupid I am for throwing my money away on rent. The independence is still worth it to me).

I put absolutely every purchase I make on my Amex, and pay it off in full at the end of the month. I like watching my airline miles grow, and I now have a fantastic credit score.

Also, my Excel skills have improved (hooray for skills)!

Zach is a recovering classical musician and editor living in New York City. He is all over Twitter. Photo: Timothy Boyd

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments