Executive Excess and the SEC

Nearly 40% of the nation’s best-paid CEOs over the past two decades were either fired, forced to take government bailouts or in charge of companies that paid huge amounts in fraud-related claims.

That’s the conclusion of a report Wednesday that attempts to gauge the link between weak corporate performance and skyrocketing executive pay.

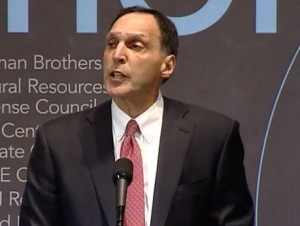

It shouldn’t come as a surprise that executives like Richard Fuld, the former head of Lehman Brothers, was one of the country’s best-paid CEOs, but as we know now ran a company that crashed and burned and helped drive our country into a crisis. But it’s good to be reminded of that — especially now that companies are pushing back against a new rule proposed by the Securities and Exchange Commission that would “require public companies to report how much their employees are earning compared with the CEO.” Yes to this kind of transparency.

Photo: Wikimedia Commons

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments