How To “Do Your Taxes” Without “Doing Your Taxes”

Disclaimer! I am not a tax person and don’t know what I’m talking about. If you want to read about this issue from the POV of someone who knows what they’re talking about, may I please direct you to the lovely and informative IRS WEBSITE.

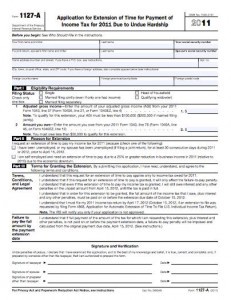

Behold: Form 1127-A: Application for Extension of Time for Payment of Income Tax for 2011 Due to Hardship.

This form is part of a program called FRESH START, and it gets rid of the failure to pay fees (discussed here!) for people who cannot pay their taxes on April 17!

BUT HERE IS A SMALL SADNESS: You have to have actually done your 2011 taxes in order to use this form. 🙁

HERE IS WHO CAN USE IT:

- Wage earners who have been unemployed at least 30 consecutive days during 2011 or in 2012 up to the April 17 deadline for filing a federal tax return this year.

- Self-employed individuals who experienced a 25 percent or greater reduction in business income in 2011 due to the economy.

- A taxpayer’s income must not exceed $200,000 if he or she files as married filing jointly or not exceed $100,000 if he or she files as single or head of household. This penalty relief is also restricted to taxpayers whose calendar year 2011 balance due does not exceed $50,000.

IF THIS DOESN’T INCLUDE YOU: That’s fine. It’s not that big of a deal. It’s only saving you .5% of what you owe anyway, which is fairly negligible, in my opinion. And I don’t think it gets rid of the interest payment (3% of what you owe per year), but it might; the IRS website is impossible, basically. Can anyone else figure it out?

You can read about it yourself right here.

Or if you’re an auditory learner, there is a podcast (!) available here.

And if you really just want to watch a video, the OFFICIAL IRS FRESH START YOUTUBE VID is here.

BUT WHAT IF YOU KNOW YOU ARE GOING TO OWE BUT YOU STILL HAVEN’T DONE YOUR TAXES AND YOU PROBABLY AREN’T GOING TO BY APRIL 17, WHO ARE YOU KIDDING: You MUST file Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return! That gets rid of the terrible Failure to File penalty, which is 5% of what you owe, per month! Which is actually a lot! So do that. You have to know some numbers from last year’s tax returns, but you can figure this out. I believe in you (I believe in me). You can’t do anything about the failure to pay fee (I don’t think? Maybe there is another form hidden in the annals of the IRS website, but I couldn’t find it?), but that one’s not as bad, and we’ll all just cross that bridge when we get there. I hate all of this.

Related: Mike Dang and I could not be more opposite in any way, at all, it’s impossible.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments