I Finally Saved $10K (Again)

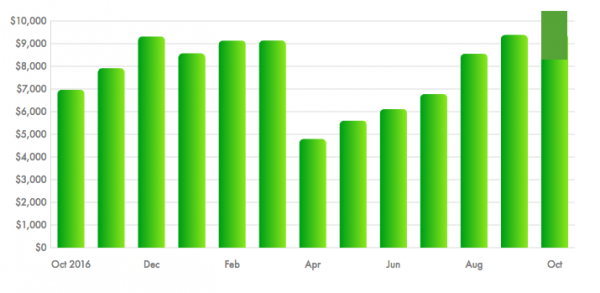

I’ve been hitting refresh on Mint for the past 90 minutes hoping the savings account transfer would show up. It hasn’t yet, so I did a little photoediting to show you what this graph SHOULD look like.

Every Friday, I transfer 25 percent of that week’s freelance payments into a sub-savings account labeled “25 Percent Taxes” and another 15 percent into a sub-savings account labeled “15 Percent Savings.”

As of this afternoon, the savings account balance is $10,073.75.

We used to have a series on The Billfold titled “The Year I Saved $10K.” (If you’re interested in reviving that series, feel free to pitch me.) I didn’t actually save $10,000 between October 2016 and October 2017; as the Mint Trends graph indicates, I saved $2,354 between October and December, spent some of my savings between December and April (that big drop between March and April represents the extra money I owed in taxes and my decision to start putting 25 percent of my income aside for taxes instead of 20 percent), and then saved $5,283 between April and October.

Still, it feels like hitting a significant milestone. $10K in savings, plus a $3K “savings buffer” in my checking account.

My savings account won’t stay above $10K for long; I’ll be pulling some of that money out for my Roth IRA, and I may end up spending some of it to move halfway across the country.

But then I’ll start building it back up again.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments