What Am I Going to Do With My Increased Income?

A lot, or not a lot, depending on how you look at it.

Yesterday I wrote that I had hit a financial tipping point: my last bit of credit card debt will be paid off this month, which means I will no longer be putting aside 20 percent of my income towards debt repayment; also, my income is increasing, which means I have more discretionary money at my… um… discretion.

Checking In With My Savings Plan: September Edition

So what am I going to do with all of this?

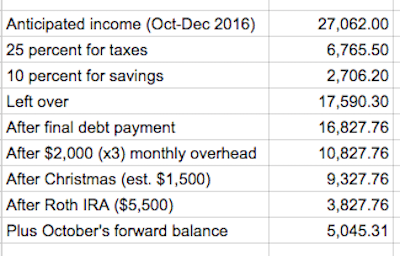

Let’s start by looking at the numbers.

So this Google Sheet should be self-explanatory, but in case it isn’t: I’ve taken the income I anticipate earning for the remainder of the year and subtracted my major expenses and financial goals. My new CPA has recommended I start putting aside 25 percent of my income for taxes, so I’m bumping that percentage up. I’m also including my estimated holiday costs and the Roth IRA I want to fund by the end of the year.

With those figures subtracted, and the $1,217.55 balance I had in my checking account added at the very end, I’ll have roughly $5,045.31 in discretionary income between now and the end of 2016. We’ll call that figure $5K, for simplicity’s sake.

$5K sounds like a lot (and it is), but it has to cover all my discretionary expenses, including:

- Clothing

- Haircuts

- Restaurants

- Uber/Lyft rides

- Charitable donations

- Business expenses

That last category is an important one, because I’m going to have a significant business expense coming up pretty soon. I have a meeting with the Apple Geniuses tomorrow—eight days before my three-year AppleCare Protection Plan expires—to determine whether it is even worth it to try and fix my dying MacBook Air, or whether it’s time to start shopping for a new one.

So let’s say that I’ll need to set aside $1,500 of that $5K for a new MacBook Air and a new AppleCare Protection Plan, whether I end up buying it this year or waiting until the new MacBooks are released in early 2017.

That leaves $3,500.

Looking at my Mint records reveals that I spend about $1,100 per month on discretionary stuff like clothing, haircuts, charity, rideshares, and restaurants, so multiply that by three and subtract it from $3,500 and you get $200, which… you know what, I told Ester I was going to buy a new coat, so let’s say that brings the balance down to $0.

Friday Chatting About Change (Both Kinds!)

And that’s what’s probably going to happen to all that money. I’ll end the year debt-free, with $5,500 in a Roth IRA and $9,000 in a savings account. I’ll be able to fund the holidays and a new laptop without putting anything on credit.

I won’t be able to buy anything extra like a new couch, though—not unless I adjust my discretionary spending or pull money out of savings. But that’s okay. I already said that was a financial goal for 2017.

One Year With Ikea’s Second-Cheapest Sleeper Sofa

There’s one more thing I need to add: this income boost is in part because of a freelance project that’s scheduled to complete at the end of the year. I’m not anticipating that I’ll continue to earn at this level in 2017—although who knows what will happen—which is why I’m doing things like setting aside cash for a laptop now, and making sure I have a hefty savings account.

So now you know my financial plan through the end of the year (and beyond), and I look forward to your thoughts and suggestions in the comments!

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments