I’m Just A Bill

The first Labor & Delivery charges arrive

I got the bill, I got the bill! Well, the first one, anyway, the one from my insurance company telling me what the charges from the hospital should be. That should be good information for the pool, right?

Before we delve into what I might be charged for labor and delivery, let’s get some context. How much is the average L&D bill?

A recent write-up in Women’s Health on the subject solicited stories from nine new moms. I winced at the article’s subtitle (“The prices range from not so much to “You charge WHAT to pull a baby out?!”) and then I winced harder at the stories themselves. Some of them are pretty upsetting.

I almost had a breakdown after my son was born, and it wasn’t due to new-mom anxiety. Despite having “great” health insurance, my husband and I were handed more than $5,000 in hospital bills.

As if the price tag wasn’t painful enough, the invoices trickled in over the span of nine months. We’d scramble to pay off a large bill and — bam! — another one would arrive in the mail that was due in two weeks.

I tried to fight a few of the more outrageous ones, like the $800 bill for “blood” since I never had a blood transfusion. I was laughed at by a hospital administrator — she told me that I’d never be able to successfully get rid of the charge, that we were billed because the hospital had blood “in case” I needed it…but I hadn’t.

We had saved up for months to lessen the financial blow of my maternity leave and new baby expenses. That money was wiped out in a month, all because of hospital bills.

An $800 bill for “blood” that she neither asked for nor used? That’s pretty epic.

Here’s another, possibly equally surreal, from a woman whose birth cost her $2,000:

I stayed in the hospital for less than 24 hours. I did not use any medication. But because I opted for a ‘natural’ or un-medicated delivery, I paid much more than many friends who were covered upfront by insurance and used far more health services, including way more medication and diagnostic tools and had far longer stays in the hospital.

There seems to be no relationship between having seemingly good insurance and not having to pay thousands and thousands of dollars anyway; or, for that matter, between having a less medicalized birth and saving money. Having a baby appears to be a game of Russian Roulette. If you’re lucky, there’s no bullet in the chamber when you pull the trigger. If you’re not lucky? You’ll be paying bills for years to come.

And those bills are considerable, as we know from more than just anec-data. Costs related to labor and delivery have soared. Check out these Childbirth Connection graphs, which break down the increases by state.

One thing is clear: it would be in everyone’s financial interest to get more parents delivering in birth centers rather than hospitals. Like the one about to open in western North Carolina, those offer a “homelike setting” that’s nonetheless staffed by professionals:

“I have worked as a doula for 13 years,” Major says, “And I worked with close to 130 couples. Time and again they say, ‘How come there is not a birth center? I don’t feel quite safe at home, but I want that experience.’”

It’s important to provide options and make a safe space available to women who for one reason or another want to use a birth center, she says. “Birth is normal, and we shouldn’t be acting like it is something wrong unless, in fact, something is not right.”

A true emergency in a birth center is extremely rare, Major says. Chapel Hill’s birthing center had 500 births last year, with only one maternal transport and one infant transport, and both outcomes were fine, she notes.

Yet lots of areas still don’t offer birth centers. That means a pregnant person has no middle ground option between delivering at home — which can go blissfully well, a la Emily Gould, or season-finale-level badly, a la “Girls” — or surrounded by doctors and machines.

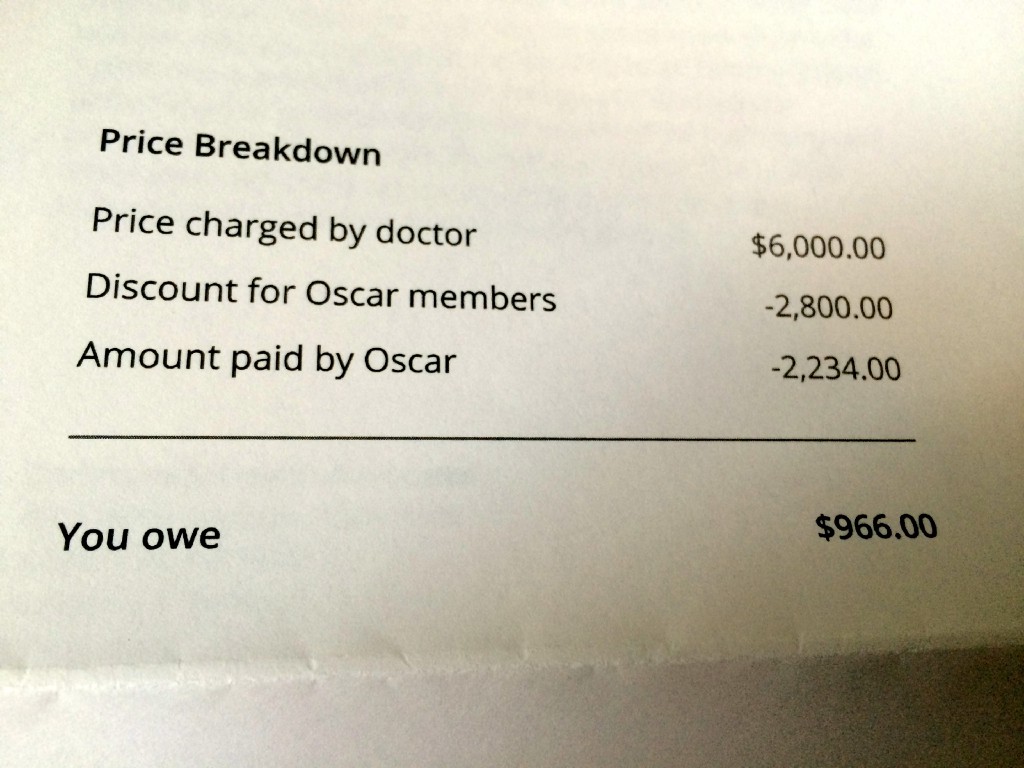

I gave birth with a midwife at a “birthing center” that was part of a hospital, which is more or less the best you can do around here. Ready for the amount it’ll set me back, at least according to the tally of my insurance company?

Okay! That seems … reasonable, considering? Especially since I have a deductible and out-of-pocket max for the year of $1,000, total. If the actual charges end up being only (“only”) $966, I’ll feel like I got off easy.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments