The “30 Under 30” May Or May Not Be More Talented Than You But They Are Better Off

The “30 Under 30” May Or May Not Be More Talented Than You, But They’re Better Off

For the first time, at least that I’ve seen, Forbes has been up-front about what makes genius possible. In this year’s iteration of its “30 Under 30” lists, the magazine also included some fascinating infographics about who these brilliants are — and what kind of education, family background, and so on has enabled their work.

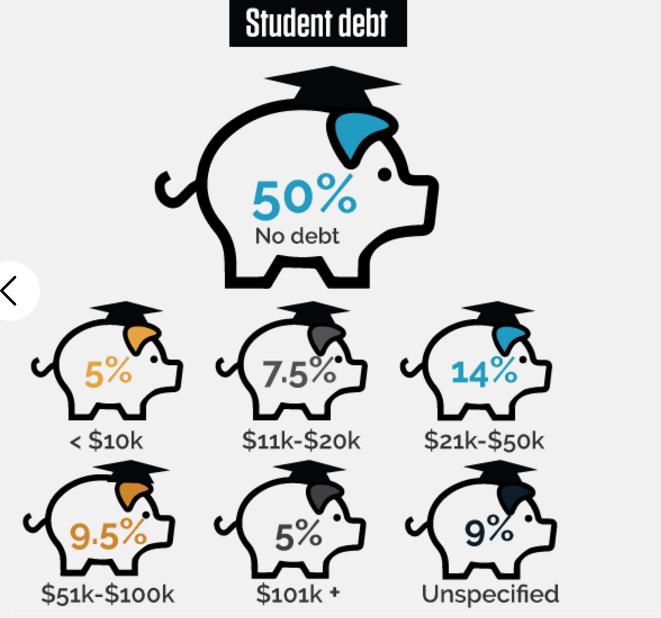

50% of all of their brilliants, for example, have no student debt, zero. That’s despite being, duh, under 30.

That’s in pretty stark contrast to Millennials as a whole:

two-thirds of millennials (those aged 23–35 in 2012) have at least one source of long-term debt outstanding — whether student loans, home mortgages or car payments — and 30% have more than one. Among the college-educated, a staggering 81% have at least one source of long-term debt.

Now, of course, being brilliants, they could have gotten full or partial scholarships, or chosen their academic avenues wisely. More likely, though, I’ll bet, is that they had generous parents who were able to support them in a higher proportion than Millennials in general.

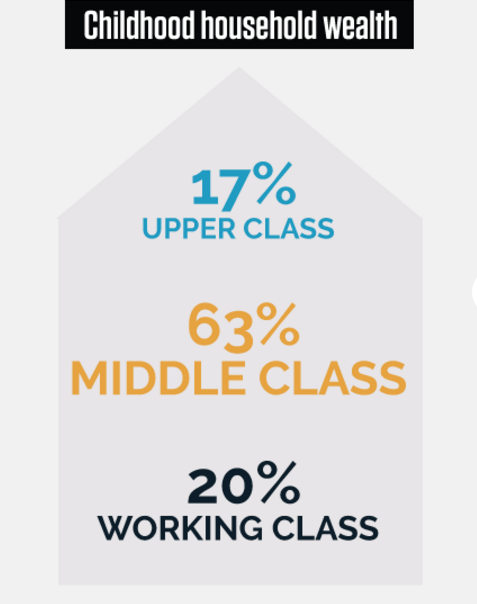

They do seem to have come from wealthier families than Millennials in general: 80% of them hail from either the middle- or upper-classes. (No word on whether their use of “class” refers, as it should, to more than income.)

None of this is to diminish their achievements. It’s intended only to provide some useful context and a reminder that making it, especially as a young, is about talent and hard work, sure, but it’s also about opportunity, connections, luck, and, perhaps most crucially, not being encumbered by too many responsibilities.

Encouragingly, these young people seem to have their priorities straight. Although I suppose one could argue that it’s easier to define success more abstractly than “wealth” when you have wealth already, or your family does.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments