“Most Americans Have Less Than $1K In Cash”? Nope

A Closer Look At That “Most Americans Only Have $1K In Cash” Story

Esquire’s recent extremely popular suggestion that we panic about how “56 percent of Americans said they have less than $1,000 in their checking and savings accounts combined” — which has been viewed over 30K times in just a couple of days — comes via Forbes via a site called Magnify Money. Like in any game of telephone, some of the original context has been lost. Let’s dig into that context a bit, shall we?

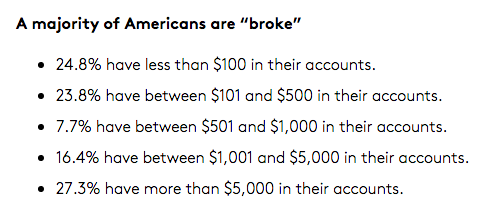

The original Magnify Money survey looked at American consumers in our drained, hungover, post-holiday state, and determined that we’ve got nothing in our pockets but lint and the occasional fly.

We didn’t make a plan for how we would spend our Christmas present dollars, or if we did make a plan, we overspent anyway.

Indeed, that’s pretty dire! But before we take any information too seriously, we should examine how the number crunchers got their data, right? Here’s their methodology:

The survey was conducted by Google Consumer Surveys for MagnifyMoney between December 24–26, 2015. 518 people responded to the questions in a nationwide, online survey. All respondents were 18 or older.

Uh. I’m not a STEM grad, but that does not sound, well, sound. “518 people” who were willing to answer questions online is a small sample, and surely it’s not a random one from which we can safely extrapolate about “a majority of Americans,” let alone “the average American.”

Pew’s methodology page on its website agrees that “internet surveys are not without their drawbacks.” Specifically, there is “no systematic way to collect a traditional probability sample of the general population using the internet.”

Another recent and very buzzy survey by Go Banking Rates in September, which found that “62% of Americans have less than $1000 in savings,” was also based on Google Consumer Survey data. At least in that case the sample size was 5,000 individuals, not 500, and the numbers are served up with a side of caveats:

The responses are representative of the U.S. internet population, with a margin of error within 1.70 percent. Demographic information was not available for all respondents, and analysis of responses by demographics is based solely on responses for which the targeted demographic information was available.

Anything based on an internet survey has to be taken with a hefty shake of salt. Older people are going to be less well-represented among people who are willing to answer a Google Consumer Survey online, for example, and yet they’re more likely than the youngs to have ready money. (Did you know that it’s Boomers, not techies, who are largely the ones buying houses for cash in San Francisco?)

Basically, Esquire’s headline should read, “Of 500 mostly young Americans willing to answer some questions online right after the holidays, a whole bunch of them overspent on Xmas and are now broke.” But that wouldn’t have been as click-baity.

It is sobering that so many of us spend more than we mean to, during the holidays and at other times over the year; that we accumulate ruinous amounts of credit card debt; and that we have little enough in savings that we would have a hard time coping with an emergency. Any attention drawn to those problems is good attention. It should just also be based on good science.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments