High Incomes, Little Savings

If you have a well-paying job, but can’t seem to shake off the feeling that you’re not making much financial progress when it comes to saving, Quartz has the article for you. Looking at the Federal Reserve’s Survey of Consumer Finances, Quartz finds that many middle- and upper-middle-income households don’t have a ton of financial assets (AKA retirement funds, which may not come as a surprise if you’ve been reading about the retirement crisis), nor liquid savings for emergencies:

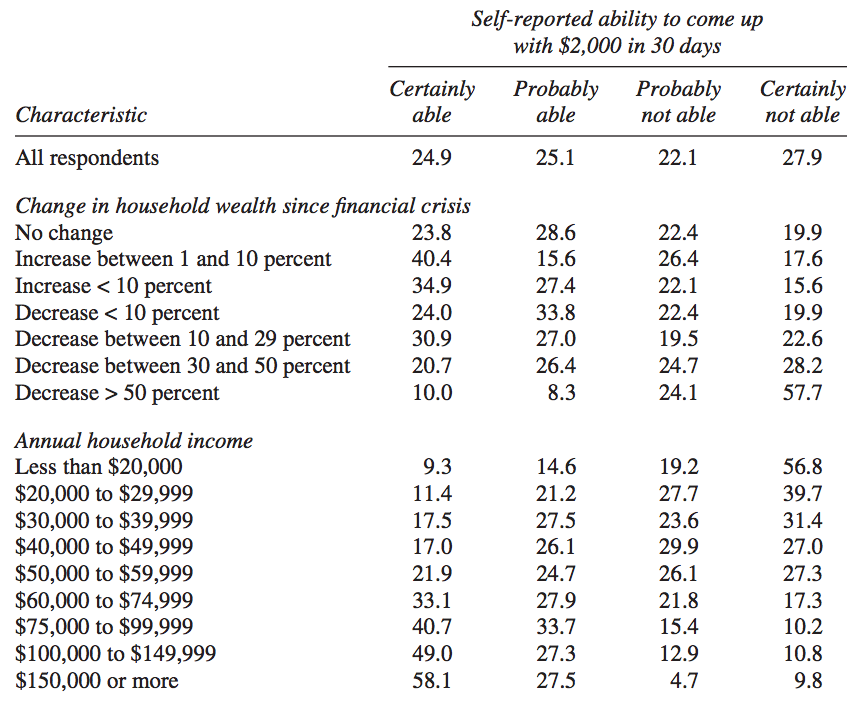

…after putting money into their retirement accounts, people don’t have much left over to save in other ways or don’t feel the need to do so. But this could also lead people to rely on those accounts in a pinch, which is a bad strategy since retirement accounts are less liquid and incur penalties for early withdrawal. The fact that the average upper-middle-class household has just $12,200 in non-pension financial wealth is disturbing. Even worse, within that group, about 25% of the higher earning population had only $3,200 in 2013. It’s no wonder one quarter of all American households couldn’t come up with $2,000 if they faced an emergency — it’s not just low earners.

That last bit of data comes from a Brookings Institute study on “financially fragile households” which looked at not only how many households could come up with $2,000 in 30 days, but how they cope when the money isn’t readily in savings (in order of popularity, those coping strategies include: borrowing money from family, working overtime or a second job, selling household items, and liquidating retirement investments).

Debt is one of the major reasons why people with decent salaries find themselves in a “financially fragile” state, and Quartz writes that the majority of this debt comes not from consumer spending, but from housing and student debt. For me, finding the balance between paying off my student loans and putting money in retirement and emergency savings (and staying out of consumer debt) is how I’ve escaped a state of financial fragility; which is good because there is no money available to be borrowed from family members, it would be nearly impossible to work more hours than I already do, and liquidating what I’ve put away for retirement would feel devastating.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments