Hilariously Bad Financial Advice You Should Not Take But Should Enjoy Reading Nonetheless

When confronted by something that is more wrong than Ann Coulter, more wrong even than the combination of toothpaste and orange juice or the TV executives who canceled “My So-Called Life” — so utterly, spectacularly, and in all other ways wrong, in short, that it should require a Trigger Warning that it could induce seizures — what is the proper response? Reason and logic, or an array of .gifs? Let’s try both and see what happens.

Here is a sample of the blithely hilarious blather to which I am referring, from a piece titled, “If You Have Savings In Your 20’s, You’re Doing Something Wrong.” Although it is quite entertaining — which is good! you can get away with anything on the Internet as long as you keep our attention — it does not seem to be satire. For one thing, it’s running on Elite Daily, a site the Awl once described as “an astounding troll hole” that mixes “class aspirationalism with its obscene misogyny.”

If it turns out that it is satire, and I have been taken in, I will admit that author Lauren Martin is a Jonathan Swift-level genius. But let’s assume Martin means every line of the following intro, even though it reads like a tone-deaf version of Cher’s monologue at the beginning of Clueless:

I don’t know about you, but I like to enjoy my life. I like to go out to eat, buy clothes I don’t “need” and spend money with friends on memorable nights out.

This goes back to a piece of advice a very successful friend gave me: “Don’t save money. Make more money,” he nonchalantly stated, pushing me into a taxi.

Unlike most things people tell me, this advice did not go in one ear and out the other; it stayed with me and changed the way I look at everything from my career to my savings.

You know how one makes more money, very often? By having money to invest. Money wants to reproduce. It’s like Tribbles that way, or teenagers. But you have to give it room to breed. You can’t do that if you’re trading it immediately for taxis and cocktails.

In other words:

She goes on:

When did our 20s start to feel like our 40s? When did we get weighed down with the same pressure and stresses as a woman with four kids and a second mortgage?

We don’t have kids. We’ll be renting for the foreseeable future, and we have no problem eating McDonald’s when we’re skint.

I’ve recently figured it out: This pressure, this third-party stress, is ingrained within us. It’s this looming doom our parents carved into our unconscious, only to come out anytime we make an impulse purchase or have to spend the night without Netflix.

But like most things our parents have ingrained in us, we must consciously work to push it out.

Hahahahahahahahhaha

Martin’s parents have probably dug themselves a makeshift bomb shelter in the backyard and are huddled there now, kept warm by their embarrassment at having raised someone who would not only think such words (“this looming doom our parents carved into our conscious” — ??!?) but write them up and serve them to the Internet as advice.

I mean, “We don’t have kids”? She means that she doesn’t have kids. That’s probably for the best, since they’d interfere with her passion for 24/7 YOLO. But even assuming she’s speaking only for her sliver-of-a-sliver-of-a-subset of attractive, young, healthy, relatively self-sufficient professional urban women without dependents, student loans or any financial responsibilities at all, her logic doesn’t hold. You’re only stuck renting for the foreseeable future, for example, if you don’t amass a down payment. And why wouldn’t you if you could? What’s un-fun about being independent of the whims of your landlord and the vagaries of the housing market?

I could quote the whole thing and marvel at the wrongness that lies at the heart of each paragraph like a peach pit for one to break one’s teeth on. She says, for example, that “safety nets” are passé.

We’re taking our time growing up, refusing to be shackled by mortgages and diapers. We’re not trying to live with safety nets; we’re trying to live on the edge.

Shackled By Diapers: The Ester Bloom Story

She says that saving is for losers with no ambition.

People who are saving in their 20s are people who don’t set their sights high. They’ve already dropped out of the game and settled for the minor leagues.

Your 20s are not the time to save; they’re the time to gamble. $200 a month isn’t going to make the dent that a $60,000 pay raise will after spending all those nights out networking.

Gamble! Gamble, you fools! You’re not gambling fast enough! KEEP GAMBLING, MAKE AMERICA GREAT AGAIN

She says having money in the bank makes people timid.

You’d be surprised at how cautious people get with just a few thousand in the bank. This isn’t the time to safeguard — it’s the time to bet all your chips and hope to make it big.

As she warms to her argument, she even gets kind of Zen about it.

Those who don’t plan for the future aren’t planning for their death.

She thinks that luck — that heady, intoxicating blend of youth, health, confidence — will always be as easy to come by as Crest WhiteStrips.

Everything works out, and if you’re smart, able and had a job once, you’ll have one again.

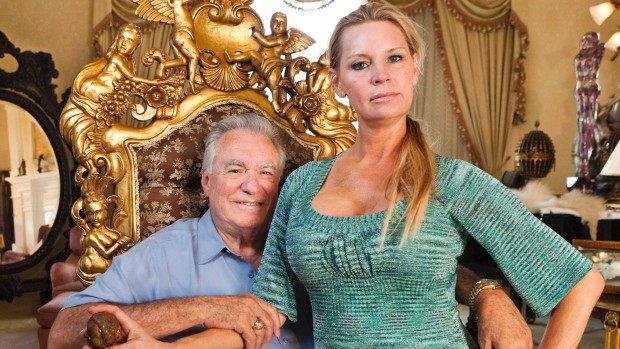

But why bother pointing out holes in what is essentially the hot take equivalent of a colander, or noting that Martin seems like the demon lovechild of Carrie Bradshaw and Sarah Palin? I’m actually kind of in awe of her. What would it be like to go through life with this kind of assurance? Yeah, you might end up like Macbeth, gutted in the Scottish moors as punishment for your colossal hubris. Or you might end up marrying a financier and living in a sprawling mansion the size of Borneo while other people make a documentary or reality show about your exploits. Not everyone receives their just deserts, not in this life.

We may as well wish her the best, as long as she keeps entertaining us, and as long as readers know they would do better to take financial advice from passing squirrels.

This could be my favorite line of all:

When you care about your 401k, your life is just “k”

I don’t know what that means, but I’d like it carved on my tombstone.

You win, Lauren Martin. I salute you. And now let us all go quietly rolling away, a la Ralph Wiggum.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments