How A Sticky Note Helped Me Get Out of Debt

by Amy Derjue

It did not take the newest financial planning app to get me out of debt. It did not take a large cash windfall or death of some mysterious, wealthy relative who I’d never met. It was a lot more low-tech than that.

My crawl into consumer debt wasn’t unlike that of most people in their 20s. I had a lot of student loan debt for a liberal arts degree. I worked at a lot of rewarding, but low-paying jobs (thanks, liberal arts degree)! I was unemployed twice. I lived in a city with friends who had far less student loan debt than I did, and I spent money I didn’t have due to a fear of missing out: I kept with their weekend trips, Friday night drinks, and clothes shopping excursions. It all added up to more than $10,000 in credit card debt.

In 2012, I was lucky enough to land a job that paid $10,000 a year more than the one I’d lost before being unemployed for a summer. I muddled along, paying as much as I could toward the balances. But I still felt like I wasn’t making any progress. It required a new strategy. Enter the sticky note.

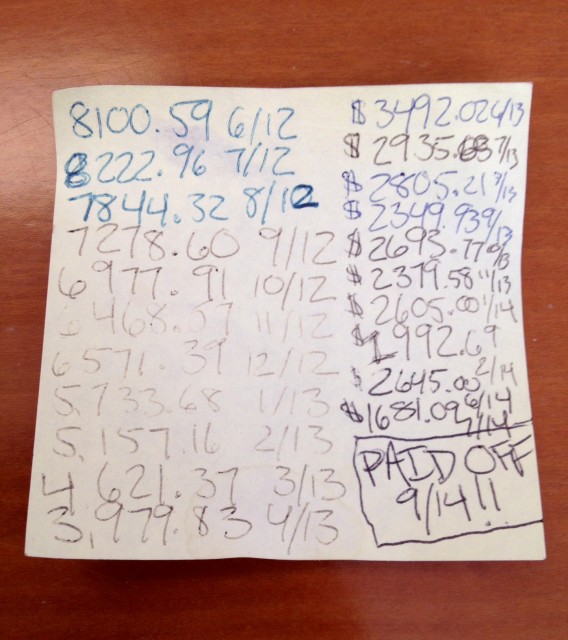

One day at work, I wrote down how much debt I had left on both of my credit cards and the date on a sticky note and stuck it to my computer monitor. Nearly every month after that, I wrote down the new total after my payment cleared. I was literally facing my debt on a daily basis.

I did all that other stuff financial experts say you should do: I paid the minimum on my low-interest card while I paid as much as I could on the card with the higher rate (AKA the avalanche method). I tried not to use the cards, although I slipped up a few times.

It wasn’t a perfect system, but it was a system that illustrated my progress in a way that seemed tangible to me. For eight hours a day, the sticky note was somewhere in my peripheral vision. I took it with me when I got an even better job with better pay and stuck it to the monitor of that computer. When I was overwhelmed by the debt, or by the work I had to do to get out from under the consequences of my bad habits, it was a concrete reminder that I was doing the best I could. And it was paying off.

I made the last payment on my credit card in September. I still have the sticky note on my desk — next to one that outlines how much money I’m putting into my savings account now that the credit card debt is gone.

For more tips on how to get out of debt, see this piece by Nicole at The Penny Hoarder.

Amy Derjue is a public relations professional and freelance writer living in Boston, Massachusetts. She’s really bad with money, but trying to get better. She blogs here and tweets here.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments