Read This Libor Story

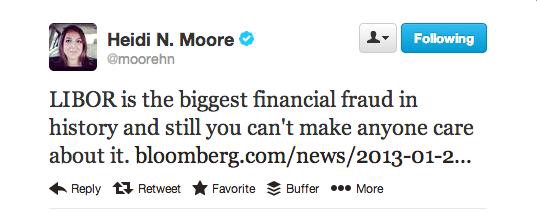

With a tweet like that, how could you not pay attention to this Bloomberg feature on the Libor scandal?

For years, traders at Deutsche Bank AG, UBS AG, Barclays, RBS and other banks colluded with colleagues responsible for setting the benchmark and their counterparts at other firms to rig the price of money, according to documents obtained by Bloomberg and interviews with two dozen current and former traders, lawyers and regulators. UBS traders went as far as offering bribes to brokers to persuade others to make favorable submissions on their behalf, regulatory filings show.

Members of the close-knit group of traders knew each other from working at the same firms or going on trips organized by interdealer brokers, which line up buyers and sellers of securities, to French ski resort Chamonix and the Monaco Grand Prix. The manipulation flourished for years, even after bank supervisors were made aware of the system’s flaws.

“We will never know the amounts of money involved, but it has to be the biggest financial fraud of all time,” says Adrian Blundell-Wignall, a special adviser to the secretary-general of the Organization for Economic Cooperation and Development in Paris. “Libor is the basis for calculating practically every derivative known to man.”

It’s the biggest financial fraud of all time, yet the general public finds it it too boring? complex? to really give it the attention it deserves. So let’s put this story on our reading lists today.

Update: Heidi’s newest column is about how nobody cares about Libor:

…there is literally no one in the United States who has ever pounded a dinner table in outrage over government complacency, yelling, “But if we’re so tough on financial crime, why haven’t we thrown those obscure Asian bureaucrats of a foreign bank into the slammer for fixing a London-based interest rate?!”

No. What US consumers wanted was the prosecution of American banks, for American crimes. Insider trading. Mortgage fraud. Foreclosure abuses. Unjust, overdone compensation for executives and managers who failed to uphold ethical business standards.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments