Hourly to Salary and Back Again (Maybe)

Unintended consequences of the FLSA.

By Anonymous

My first job, at age 16, was as a student custodian. In that job, I learned how to clean all sorts of things. I also learned that I don’t like punching a clock.

After eight years of working for a salary or monthly stipend, I will soon be back to working hourly. I have not changed industries or even employers. Instead, the law has changed. I am one of the 4.2 million American workers impacted by the May 2016 update to the federal Fair Labor Standards Act. Because my annual compensation falls below the new cutoff of $47,476, and my job duties classify me as nonexempt, my employer must now pay me overtime if I work more than 40 hours per week.

Then again, maybe not. On November 22, a federal judge blocked the rule. In addition, the rule was changed through an executive order, so no one knows what will happen after January 20. For now, I’m choosing to proceed as if the change is going to stick — if not at a national level, then at the level of my employer. I work at a large public research university. The gears of change move slowly around here, but once they start going, there’s a lot of institutional inertia to keep them in motion.

Conceptually, I understand the value of updating the law. The previous cutoff of $23,660 was very low, meaning there were many workers being paid small salaries who could be expected (and exploited) to put in overtime without additional compensation. Women and people of color are disproportionately affected by the new rule — and that’s a good thing. However, I am one of those fortunate salaried workers who never puts in more than 40 hours per week. On the rare occasion I’m stuck in the office late or need to come in early, my employer has a well-developed system of comp time that will continue after December 1. Basically, I will never receive overtime pay.

As my employer adjusts how it compensates this new group of workers covered by FLSA, my pay will start to arrive biweekly instead of monthly. To be clear, the law doesn’t have any stipulations for how frequently employers must cut checks — I imagine the university is just moving us to the same payroll system and schedule as all of its other hourly workers.

Back in July 2007, it was tough make it through that initial month of work before I got my first paycheck. I was fresh out of college, poised to move from a dumpy shared house to my own apartment, and I sweated out the month living off the small amount I had saved from student jobs. Since then, I’ve grown to appreciate monthly paychecks. My salary drops into my checking account on the first of the month, I pay all of my bills within that first week, and I know exactly how much I have left to live on for the rest of the month and how much I can move to savings.

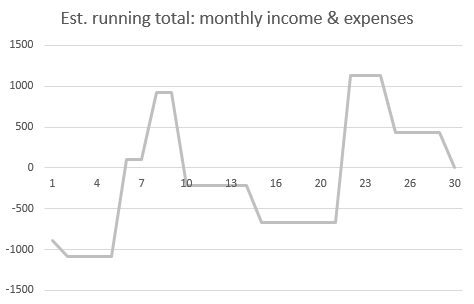

Going forward, it’ll be a period of adjustment as I learn to sync up monthly expenses with biweekly checks. I’ve shifted some automated payments, like my IRA contribution, later in the month to help spread things out. I’ve even done some (amateurish) modeling to visualize the input and outflow from our checking account:

To account for the ups and downs, my husband and I have decided to maintain a significant buffer (exact amount to be determined — maybe $1,500) in our joint checking account. It won’t be earning interest, but it’s not like it would’ve been earning much interest in a savings account, either.

Beyond all of the logistics related to salary vs. hourly compensation and monthly vs. biweekly paychecks, the FLSA update has also led to more abstract, even existential challenges. In my department, it has served as a new divide between those who are exempt and those who are not. Though I cannot speak for all of the newly nonexempt employees, I can say that for myself and those I am close to, this change doesn’t feel good. It feels like a demotion.

As state employees, our compensation has always been public record. However, this current focus on our income has highlighted the fact that employees in my role are among the lowest paid white-collar staff in the department. My best guess, based on public salary information from 2015, is that one-third of department staffers will be moving from nonexempt to exempt. Included in this third is all 10+ of us in my role. In the last several weeks, I have spoken with friends and family members in other industries whose employers have chosen to raise salaries above the cutoff. In my department, this route is either not possible or not being pursued.

It’s also hard not to question my overall value to the organization when I am receiving relatively little in compensation, and when that pay is currently in the spotlight. Recognizing this, leaders in the department have tried to assure us that our work is vital to the overall mission. During these speeches, however, I find myself preoccupied by the fact that the individuals speaking make two times, three times, even six times more than I do. They’re not personally affected by the change. It’s also become clear that they don’t really understand how the new rule has impacted our professional identity and our morale.

And then, of course, there’s the reality that I’ll soon be back to punching a clock. Well, not exactly. Rather than lining up a little card in a machine like I did when I was 16, I’ll log onto an intranet site every day to record my hours. I’m trying to focus on the benefits of this new system. For example, it’ll soon become a lot easier to take an hour or two off without a complicated documentation process and a silly amount of communication with my boss. I’m keeping in mind a friend with small kids who fought like hell, unsuccessfully, to keep her hourly job at a tech company from going salary so she could preserve some work-life balance. And I’m trying hard to shut out the voice of 16-year-old me, the one who’s looking around astonished that I’m working an hourly job at this stage in my career.

This story is part of The Billfold’s Change Series.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments