What We Do And Don’t Save For

According to a T. Rowe Price study via Forbes, a lot of American parents have impulse control problems: around 30% of us save for annual events like the holiday season but not for events that are further away yet both more expensive and (arguably) more important, like retirement and sending our kids to college.

It makes sense! Though investing sensibly can feel noble, it doesn’t result in any kind of chemical rush of joy to the brain. Buying your kid that bike she wants means seeing her light up like the Chrysler Building now. That kind of gratification — for both of you — is hard to resist. Sure, prudence pays off in the long term, assuming you live to see it. Prudence isn’t the only consideration.

The ideal, of course, is to do both. Get your kid(s) something that will make them happy and also tuck something away to guard against an uncertain future. Involve your kids in that, even. Get them excited, to the degree possible, about putting some money in a large-scale piggy bank so that eventually they can have the best treat of all: a more secure adulthood. I’m sure that’s what Ron Lieber would advise. (Another thing to love about Ron Lieber: the first word of his website bio is “Husband.” Then “Dad.” Then “New York Times Money Columnist.”)

A T. Rowe Price advisor quoted in the article agrees too.

The key, he says, is understanding that you can achieve multiple goals, and spending less on the holidays doesn’t mean spending nothing on them. “Part of your gift to a child might be money you put aside for their college education,” Ritter says. “You can wrap multiple goals together.” …

“Our long-term goals, such as retirement savings and having an emergency fund, should always take priority over anything that is presented with a bow and purchased during a Back Friday sale,” Ritter says.

Whatever you do, don’t go to the opposite extreme and take a hammer to the piggy bank for the sake of Christmas.

7% of parents have tapped their retirement savings and 9% have raided their emergency funds to cover holiday spending. … 62% of parents with 8- to 14-year-olds in January 2015 agree with the statement, “I spent more for my kids over the holidays than I should have.”

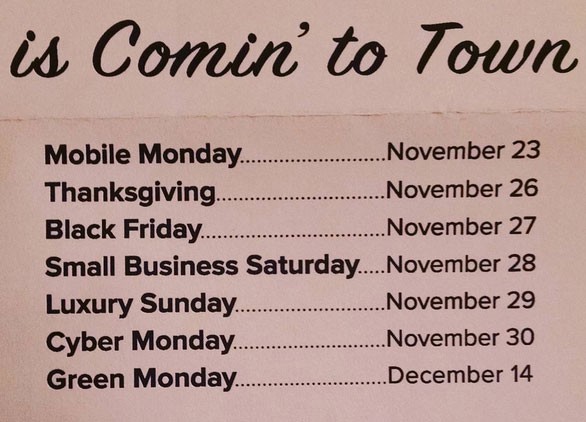

This isn’t surprising, considering that so many parents — and American in general — and primed to over-spend between November and January. Via Budgets Are Sexy:

Still, raiding emergency savings should be, you know, a last resort, not a solution to jump to when your tween won’t stop screaming in the Toys R Us aisle. It’s also a dangerous precedent: it sets up an expectation in your children that you will go all out next year too, no matter the cost. Sometimes not saying “no” now just means having to say “no” later, when it will be even harder and the tantrum twice as loud.

No wonder parents who overspend during the holiday season are two times as likely, according to the same data set, to fight with each other. Spending more than you want to is stressful.

I don’t have a specific budget with line items the way Nicole does, so I don’t have a dollar figure that I’ve settled on for what I’m comfortable spending on the holidays. My longstanding default position is, As little as possible, so long as everyone feels appreciated or even happy. As you can imagine, this “plan” often backfires. It’s very different to spend five hundred or a thousand dollars on the holidays if you know at the outset that you can afford that and are psychologically prepared. Most of the time, instead of doing that, I get to January, realize I spent that much, and waste mental energy fretting about it.

Dysfunctional, sure, but that’s my holiday spending tradition! What’s yours?

This piece is part of our Holidays 2015 series.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments