A Conversation With My Dad About His Money and My Lack Thereof

My father and I recently had our annual recorded discussion about money. This one went mostly okay.

Logan Sachon: What are you watching?

Mike Sachon: I flip between CNBC and Bloomberg. Trying to keep abreast of the world stock markets and the world economies, since I’m invested in some domestic stocks and some foreign stocks. And some foreign ETFs.

LS: What’s an ETF?

MS: It’s baskets of foreign stocks, is what it is, basically.

LS: How do you pick what you’re going to invest in?

MS: I read Barron’s magazine and I watch these television shows, and I do research at the online brokerage.

LS: So you make your own investment decisions?

MS: Right.

LS: And you’ve always done it that way?

MS: Yeah. I started investing in a tax-sheltered savings, like a 403(b) since I was a public employee. It’s the same as a 401(k), but the tax rules about it are different, slightly. I started doing that when I was about 30.

LS: What precipitated that?

MS: I don’t remember exactly. At that time I was in an MBA program, so I had taken some finance courses and that probably was the impetus to think about investing.

When I first got out of school I worked computer programming at a defense contractor in Virginia Beach. I lived at home for a year and saved enough money for the down payment I needed to get into a small house.

LS: Did you consider that an investment when you did it?

MS: I considered it a better standard of living than I would have if I was in an apartment. And I knew, even if a house doesn’t appreciate, even if it stays the same, you’re paying off the loan, and the interest on the loan you’re able to write off against the tax liability, which lowers the total cost of the loan. And eventually you start paying off the principal that you borrowed of the house. So eventually when you sell you can make some money. At that time, houses were going up two or three percent a year, so I didn’t think I was going to make a lot of money.

But I still own that house. I paid off the loan and I’ve had rental income for 28 years. But at the time, it was a pretty equivalent choice — I had a three-bedroom house and the cost was about the same as a two-bedroom apartment, the monthly cost. And now the house is worth five times what I paid for it. Even after the correction, after the real estate collapse of 2008.

LS: Correction. I haven’t heard that before.

MS: Markets correct, and the real estate market corrected. It was a bubble with inflated prices.

LS: Up until 30, did you have excess money?

MS: No.

LS: That makes me feel a lot better. Like I still have some time. I’ve got two years to buy a house.

MS: You don’t have to buy a house. That’s not feasible.

LS: Actually I have one year. Fuck.

MS: Ha, yes, you have one year.

LS: Okay, so when you decided you wanted to start investing, where did that money come from?

MS: Tax-sheltered payroll withholding, so it was through work, you could save money before taxes. So you could save $100, but it would only reduce your takehome pay by $80. When I bought my first house, I was making $10,000 a year, and my house payment with taxes and insurance was $315.

LS: Can you explain to me the difference between going to a casino and playing the stock market?

MS: In my mind, and I’ve played it every way, when you invest in stocks, you look for growth companies, you look for companies that pay dividends and have a history of consistently paying dividends. You look for value stocks that are good companies that for some reason have not looked at favorably by the market, so they might be opportunities, to buy low and later sell high, and then the fourth time is totally speculative buying, that’s kind of like Vegas. You’re buying a story and it can be like playing roulette.

LS: Have you done all of it?

MS: Oh yeah.

LS: Why?

MS: Now I buy individual stocks. Before, the 403(b), you didn’t have a lot of investment choices. Initially it was a fixed account that you would save money and it would pay compound interest. Even saving in a fixed account, compound interest will let that grow over time.

LS: And you didn’t start with compound interest til you were 30.

MS: Right. And so. Initially the 403(b) plans were offered from life insurance companies. They were fixed accounts, tax sheltered savings, you couldn’t invest in stocks. But once the opportunity became possible to invest from stocks and mutual funds, I switched my tax savings to an account that let me save and invest in mutual funds.

LS: Was that a gamble? Because the compound interest was a sure thing.

MS: No I viewed it as an opportunity, because stock markets tended to average 8 to 10% over the long term. So I saw it as a way to grow my wealth faster.

LS: Was it ever real money?

MS: It’s always real money, but it didn’t feel like real money at the time because it came out of my salary before I got my check. It was just money that I never saw, so it couldn’t be part of what I budgeted. And there was a time when I stopped doing it.

LS: Why was that?

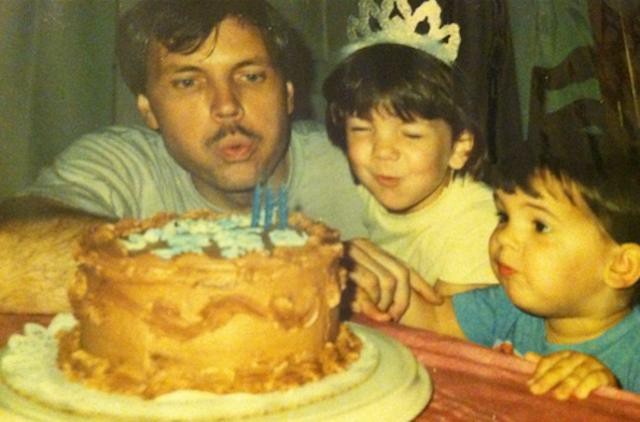

MS: The cost of private school. Actually I can’t even say it was totally that because it may have been when mom didn’t work for a year. So I stopped it, because I needed more takehome pay, because your mom, when you were little, she took one year off and then she worked part-time for another year. So that’s why I stopped.

LS: Was it stressful to stop?

MS: No. At that time we just couldn’t afford it. But as soon as she went back to work fulltime, we both started saving again, investing.

LS: So back to real money.

MS: It’s not real money you can touch. It was in a place where you’d have to fill out paperwork, pay penalties to get to the money, as well as income tax when you pull it out.

LS: So it was always for your future.

MS: Right. We looked at that as retirement savings, and we lived within the cash flow that we had other than that. We didn’t really think about savings beyond that. We didn’t think about building up a savings account. We had stable jobs. So we didn’t have six months of savings in case we were out of work, but we would save money toward buying an appliance or something. And we typically bought used cars.

And we both had stable employment, mom with the school system, me with the university. A state university.

The first six years out of college I didn’t have stable employment. My first job was with a defense job, I was there for two and a half years, and the contract we were working on got bid out to another company. And then when I first got a job at the university, I was employed by a National Science Foundation grant, and that was three years, and that was soft money — when that ended there was no job. Once I was hired by the university they created a position, I thought I’d finish my master’s degree and then leave, but then my job became more defined, and I ended up staying for 31 more years.

LS: Did you always know you were going to stay that long?

MS: There were a couple of times when I thought of leaving. There was one time when I thought I was going to have to leave.

Once I was over 15 years as a state employee, there was a lot of incentive to stay longer. The state pension really only becomes enough to live on when you have 30 years in the system. You can have less than that, but the amount of your pension goes down like 4% every year less than 30. So it was a lot of incentive to stay. Once you’re in a state system, employee salaries tended to be an easy target to balance the state budget, so we went many years without a salary increase. And before I retired we went three in a row without a salary increase.

LS: Before that was it merit-based, or a raise every year?

MS: A combination.

LS: When did you start thinking seriously about retirement?

MS: At one time in the middle of the nineties, the computer field was taking off all over the country. And I thought about leaving then, so that would be 15 or 16 years into my employment there. And that was a pivotal point. If I was going to stay in the system it was going to be for the long run, because that was the time to leave. And I chose to stay.

LS: Because of the pension?

MS: After 15 years, that’s really an incentive. Yeah. You see the fact that 15 years later, I would be 58 years old, and I’d be in a position to retire at 58. And that was incentive to stay. The other thing was, I had a working wife and two kids in local schools, and changing jobs meant we would probably relocate.

LS: But still, you were 40 and thinking about yourself in 20 years.

MS: Oh yeah. Your mom calls me the poster boy for retirement, because I’d been talking about it when we were married.

LS: So when you first started investing when you were 30, were you also thinking about your 60-year-old self?

MS: Yes, the idea was, in my mind, if you wanted to have a nice retirement, you needed more than one source of income. So you have to put that money aside and not even think about it to meet your monthly expenses. Growing old comes faster than you think. You’re 29 in May.

LS: 29 ahhhhh. That’s old. But no, it’s young. I’m no spring chicken. But maybe I am a spring chicken. I feel fine with my age. Only like 20% of my hair is gray. At this point, have you taken out the money you’ve invested?

MS: Yes. I started taking it out. And I decided that taking out as much — mom and I went on a big European trip, and I can show you the bank records of how much we transferred to you clowns. But I decided I wanted to take that money out for big purchases, but I didn’t like the way the taxes were working out. So I decided to refinance the house, so I got a ten-year loan at 3%, and that took care of any outstanding loans that we had and gave us enough cash so I have cash to take care of any other needs that we have. Then I can pull the money out of my tax shelter to make the payments on that loan.

LS: And you just figured that out by yourself?

MS: Yes.

LS: If you hadn’t invested that money, would you still have been able to retire?

MS: Yeah, but I probably wouldn’t. One of our 403(b) companies prepared a retirement analysis before we decided to retire and that money, the money that we had saved, really put us in a position where we could retire at age 59 and be able to afford our retirement.

LS: Did grandma and grandpa do stocks and stuff?

MS: Yeah, yeah they did. I didn’t really talk about that with them. They did some, which was good. They were in a good shape. They saved their money in treasury bills. They had some mutual funds invested and they had invested in treasury bills. I had talked to my dad about that, and what they were invested in.

But treasury bills are now a terrible investment. Because the interest rates are being kept artificially low by the Federal Reserve, so people who are saving money and have money locked in what is a safe investment, it doesn’t pay any interest. So the Federal Reserve are helping banks regain their riches but are really harming people who are looking for safe assets for their retirement money. If you have inflation at 2%, treasury bills should at least pay you a few points over inflation, but instead ten-year bills are paying inflation rate, which is ridiculous.

LS: How do you buy them?

MS: You can go through a broker, but if you’re smart you’ll go to the treasury and open your own account. I had some at one point, but when the interest rate got crummy, I moved them to mutual funds or stocks.

You have to make sure you’re earning more money than you’re spending every month. You need to spend less than you make, and that involves daily decision making. And you have to view purchases like a six dollar cappucino is $180 a month for cappucino, a $15 lunch is $480 you’re spending on lunch. You have to decide. At the end of one month, if you can save enough to go have a cappucino the next month on your savings, then do it. But you can’t have a cappuciono if you can’t get to the end of the month and buy groceries without someone sending you a grocery store gift card. You can’t go to the bar —

LS: I stopped going to the bar.

MS: I’m not talking about you.

LS: You are talking about me.

MS: I’m not talking about you. I thought we were having a conversation about —

LS: You are talking about me! You are using this as an opportunity to yell at me!

MS: I’m not yelling. Now if you want to talk about you, we can talk about you.

LS: …

MS: I don’t think you want to talk about you, and I don’t blame you.

LS: I don’t think there’s anything to talk about right now. I’m doing what I have to do.

MS: One comment. I think you’re going through this transition where you think you have this weakness in not being able to manage money, and I think that you’re slowly learning how to manage your money, and it’s empowering when you do. It’s taken you a long time to learn how to live poor. That’s what it is.

LS: You never lived poor.

MS: Well, you know. I never tried to compete with friends who had higher salaries and more stuff. And I never used credit cards to try to maintain some lifestyle. I charged over $50,000 in credit cards last year and paid zero interest and got money back for the effort.

LS: I think we’ve established that I’m not a person that will ever work for.

MS: Not if you carry a balance, it won’t. They reformed credit cards so on the credit card statement, they will show you every month what a sucker you are. But people don’t look at their statements, I guess. Or people without money don’t see the value. Or don’t see they’ll be spending $2,000 in interest on the cappucinos they bought in the last year. Credit cards cannot be used for credit. They should only be used for convenience.

LS: I don’t understand why you even have them.

MS: To get reduced-price trip to Europe. I have them to get money back. I have an American Express that gives me 3% on gas, 2% when I go out to dinner, 1% for everything I charge. So I get a check for $300 at the end of the year. And I paid no interest. That check wouldn’t feel very good if I paid $2,000 in interest in the last year.

The convenience is that the stores pay the credit card company to use the card. They don’t need your money, to use as fake money. I hope you’ve learned by now that it’s not your money. It’s your future money.

LS: Did you ever have credit card debt?

MS: No. Never.

LS: Well aren’t you something.

MS: I am.

LS: What are your worries about me?

MS: My worry is that you have this credit card debt. And you have nothing to show for it.

LS: That always confused me. If I had a closet full of designer clothes and shoes, that’d be better?

MS: No. No. That would be the same thing. It wasn’t a big emergency. I would use a credit card for a big emergency. But you just used it to increase your monthly income without thinking about how you’d pay it back. Compound interest works both ways. When you’re paying for stuff on a revolving credit card, the amount it costs goes up a lot. When you’re saving money, you want to go the longest period of time. And when you’re using credit, you’re doing just the opposite. You’re stealing from yourself and your future.

LS: So your biggest worry about me is about something I did in the past. Because I’m not doing it anymore.

MS: When are you going to have all your credit cards paid off?

LS: I have no way of knowing that. If my income stayed stagnant … forever.

MS: You need to look at your statements. You need to have an idea of what it’s costing you to continue holding that credit. So that when you do get more money, it’s your highest priority to pay that off. Because if you’re just making the minimum payment plus $5 and thinking you’re really cutting into it, you’re not.

LS: I could have enough money to have a nice life, if I didn’t have the payments. Like I’d have some disposable income. I’d be alright.

MS: I’m glad you finally admit it. In other words, what you did to get yourself in that position, before you went to New York, you doing that then, look at the detriment it had on your future, your current life.

LS: Looking back is totally pointless though.

MS: Not if you’ve learned from it. But you’ve already had two strikes with credit card debt. You got it down to zero twice. This was the third time and you didn’t learn anything. You had me pay it off. You refinanced your car, which thankfully you had enough equity in it, again, me, and you still didn’t learn a lesson. Why? But I wasn’t aware when you were building up your huge credit card debt. I had no idea. And we don’t talk about your finances, I don’t know how you’re doing, except that I know you can’t pay your taxes. So I know the hole is getting deeper. You can’t ignore the fact that you have to pay taxes as an independent contracter, and at some point you’ve got to start doing something about it. So yeah I’m worried about you.

So you keep working hard. Your income comes up. And you live the same lifestyle until you cover all this debt. That’s the way out of this. That’s the only way out of this for you. You can’t grow a lifestyle with your income until you erase that debt. And then you will have learned your lesson. Maybe.

LS: I’m not a person who has ever thought about the future much, obviously. But when I look at you and mom, I’m not going to have a pension. And I’m not going to have investments like you do.

MS: You don’t know that. You take care of your debt, and then you can start saving for retirement. You’re not going to have a pension, but most people in this country don’t have a pension. We were fortunate enough to work for a state that at least in the past was fiscally responsible.

LS: So you don’t think it’s too late for me.

MS: Of course I don’t think it’s too late for you. When your mom and I were married, I was 32 years old. I didn’t have any money.

LS: But you had a house.

MS: I had a house. But it wasn’t much.

LS: Back to investing. Is that something you have to do?

MS: You have to do it.

LS: But how do people do it who didn’t get MBAs?

MS: You’ll start a retirement fund and you can have somebody manage it for you. There are ways, companies will manage your money for you and pick your investments.

LS: So there’s no way to opt out of that game.

MS: Yeah, but it’s foolish to opt out of that game. Logan, let’s say you’re 40 years old when you’re in a position to start saving for retirement. And you put away 10% of your gross income, because when you start at 40 you need to save that much. And you do that until you stop work and between social security — there will be some kind of social security — and your savings, you’ll be able to support yourself in some way. But if you have nothing but social security, you’re going to be in a big trouble when you’re 68.

LS: But there will be a lot of people like that.

MS: So. There are going to be a lot of poor people. Why do you want to be in that boat? Why would you think that’s a good future? There’s a lot of people who aren’t going to save a penny! It’s time for you to start thinking about the future. If you had started thinking about the future four or five years ago, you’d have such a better lifestyle right now.

LS: So, let’s pretend I’ll do exactly what you say. What would you tell me to do right now.

MS: I think you’re doing the right thing, taking steps to increase your income. That’s the biggest thing you have to do now.

LS: Do you think it’s stupid that I’m living in New York?

MS: No, with what you’re doing for a living, that’s where you need to be.

LS: Do you think my generation is screwed? Do you think my future is dark?

MS: No. The answer is no. But I think looking for a job in the economy of the last four years is tough. I think the path to getting good jobs is a longer one. I think you, your generation, is having to start out with a job that is less than what you had imagined for yourself. You have to take what you can find, but you don’t have to settle for that. Use that as a starting point. I’m glad you have a job.

Support The Billfold

The Billfold continues to exist thanks to support from our readers. Help us continue to do our work by making a monthly pledge on Patreon or a one-time-only contribution through PayPal.

Comments